An excellent credit score rating can imply the distinction between qualifying for a dream residence and getting rejected outright. However what in case you don’t have months or years to construct credit score slowly? The excellent news is that there are intelligent, authorized methods to lift your rating shortly, typically in simply 30 days. These aren’t magic tips or shady hacks. They’re underused, efficient methods that make the most of how credit score scores are calculated.

Enhancing your credit score isn’t about being good. It’s about being intentional. And the 30-day window offers you simply sufficient time to show higher habits, clear up errors, and use loopholes in your favor. Right here’s the right way to begin.

1. Request a Credit score Restrict Improve (However Don’t Spend It)

One of many quickest methods to enhance your credit score utilization ratio—a key think about your rating—is to extend your out there credit score. If you have already got a great fee historical past, requesting the next credit score restrict out of your card issuer is usually fast and painless. Most firms received’t even require a tough credit score pull.

The trick is to not spend the additional credit score. Merely having extra out there credit score with the identical or decrease stability improves your utilization ratio, which may trigger a noticeable bump in your rating. A leap from 30% utilization all the way down to 10% could make an enormous distinction.

You may request will increase on-line or over the telephone. When you’re strategic about timing, this transfer alone may provide you with a lift inside one billing cycle.

2. Pay Off (or Pay Down) Your Balances Earlier than the Assertion Date

Most individuals pay their bank card payments by the due date, however what actually issues to credit score bureaus is what exhibits up in your assertion’s deadline. That’s the stability that will get reported to the credit score companies.

When you can repay or at the least pay down a big chunk of your stability earlier than your assertion closes, you’ll report a a lot decrease utilization fee. This one behavior may end up in a rating enhance inside days, particularly in case your utilization was beforehand excessive.

Even in case you can’t pay the total stability, bringing it under 30% of your credit score restrict could make an enormous distinction. Below 10% is even higher.

3. Dispute Errors on Your Credit score Report

Based on a 2021 research by Client Stories, greater than one-third of Individuals discovered at the least one error on their credit score report. That’s not a minor problem. These errors can value you critical factors.

Get a free copy of your credit score report at AnnualCreditReport.com and go over it with a fine-tooth comb. Search for accounts that aren’t yours, funds marked late once they weren’t, or balances that don’t match what you owe. When you discover one thing inaccurate, dispute it instantly with the credit score bureau.

By legislation, they need to examine and reply inside 30 days. If the error will get eliminated or corrected, your rating might leap shortly and considerably.

4. Grow to be an Licensed Consumer on Somebody Else’s Card

When you have a trusted good friend or member of the family with a long-standing, well-managed bank card account, ask in the event that they’ll add you as a licensed consumer. This technique works finest if their account has a low stability, a excessive restrict, and an extended optimistic historical past.

Once you’re added, their credit score historical past will get added to your credit score report, immediately enhancing your size of credit score historical past and utilization ratio. You don’t even have to make use of the cardboard for it to assist your rating.

Simply ensure the first consumer pays on time and maintains a low stability. Their unhealthy habits can damage you as a lot as their good ones can assist.

5. Make A number of Funds in a Month

Moderately than ready till your invoice is due, take into account making small funds all through the month. This technique, usually referred to as “bank card biking,” retains your utilization low always, even between billing cycles.

Credit score bureaus love consistency. In case your card by no means carries a excessive stability, even briefly, your reported utilization will replicate that accountable conduct. A number of funds may stop curiosity from piling up, which helps you handle your debt extra effectively.

Plus, it’s a great way to maintain spending in test. You’ll have a greater real-time sense of the place your cash goes.

6. Ask for a Late Cost to Be Eliminated (If It Was a One-Time Mistake)

When you’ve usually been a accountable borrower however slipped a few times, a goodwill letter can assist. This can be a well mannered request to your lender asking them to take away a late fee out of your credit score report.

Lenders aren’t required to conform, however in case you’ve had a long-standing, optimistic historical past with them, many will make the adjustment. Late funds can drag your rating down considerably, particularly in the event that they’re latest. Getting even one eliminated may give you a fast raise.

Be trustworthy and well mannered, and emphasize the way it was a one-time error because of circumstances like sickness, job loss, or a missed notification.

7. Use a Secured Card to Add Constructive Historical past

In case your credit score historical past is restricted or poor, a secured bank card can work quick to indicate accountable use. These playing cards require a money deposit as collateral, however in any other case perform like some other bank card. And sure, they report back to credit score bureaus.

Use the cardboard for a small, common expense like gasoline or groceries, and pay it off in full every month. Inside 30 days, you’ll start constructing new, optimistic credit score exercise, which is very necessary in case your file is skinny.

Search for secured playing cards with low charges and ensure they report back to all three main credit score bureaus.

8. Don’t Shut Previous Accounts, Even If You’re Not Utilizing Them

You is likely to be tempted to tidy up your credit score profile by closing previous, unused accounts, however that’s usually a mistake. Size of credit score historical past makes up about 15% of your credit score rating. Once you shut previous accounts, particularly these in good standing, you shorten your common account age.

You additionally scale back your out there credit score, which may damage your utilization ratio. Even in case you don’t use a card usually, retaining it open (and sometimes energetic) works in your favor.

As a substitute of closing previous accounts, think about using them for small, recurring payments and paying them off month-to-month. That retains the account alive and positively contributing to your rating.

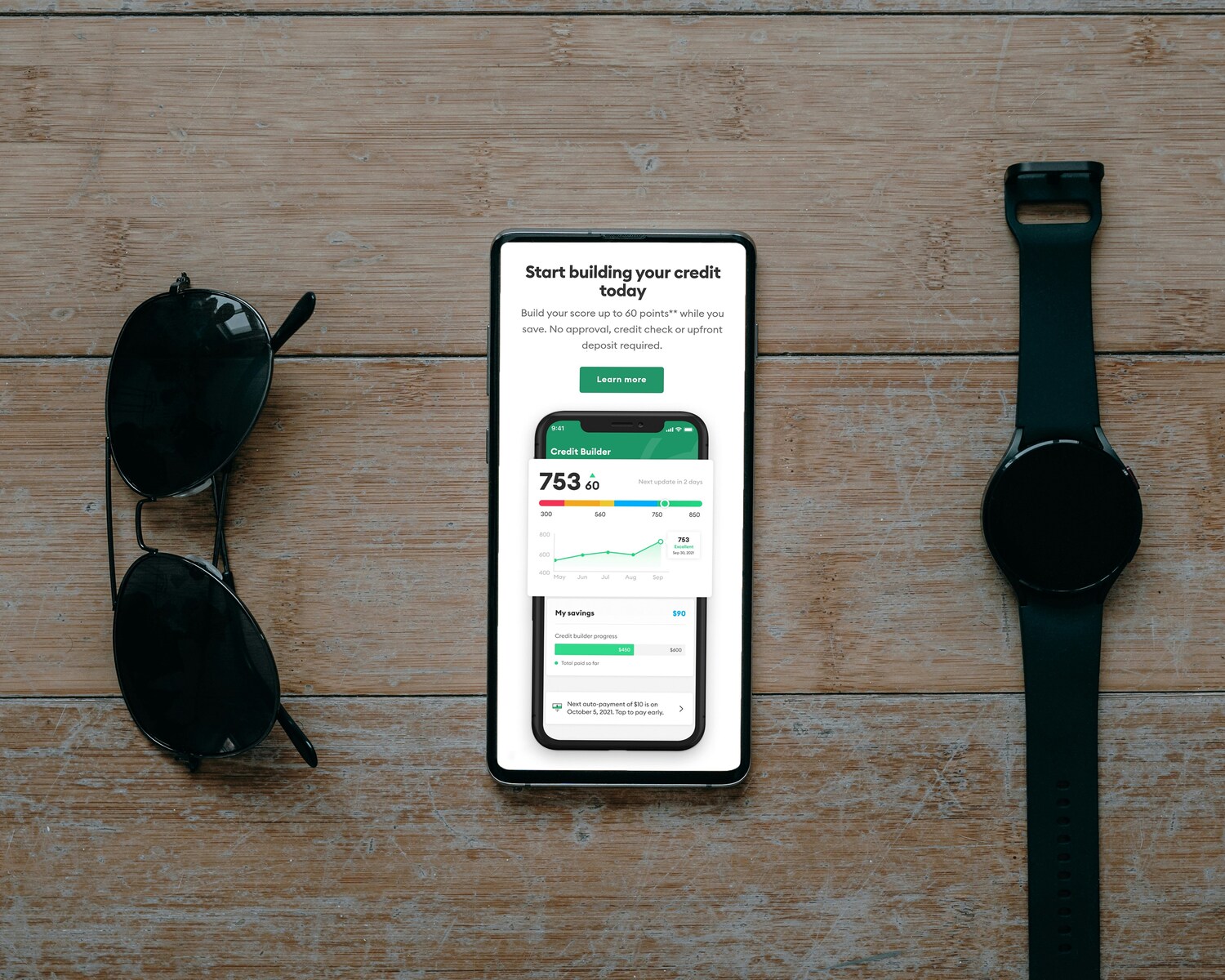

9. Use a Credit score Builder Mortgage Strategically

Credit score builder loans are small loans held in a locked financial savings account whilst you make funds. You don’t get the cash up entrance. As a substitute, it acts as pressured financial savings whereas additionally reporting your on-time funds to credit score bureaus.

When you’re rebuilding your credit score or have little or no credit score historical past, this generally is a highly effective option to show monetary accountability. And since the danger is low for lenders, approval is usually simpler. After 30 days of on-time funds, you’ll already begin seeing the affect, particularly in case you’re including optimistic exercise to an in any other case sparse credit score file.

10. Freeze Spending Whereas You Increase

Credit score restore isn’t nearly paying off debt. It’s about conduct change. When you’re actively making an attempt to spice up your rating in 30 days, now just isn’t the time to splurge on large purchases or open new accounts.

New exhausting inquiries can briefly drop your rating, and excessive balances can tank your utilization. Freezing spending for a month whilst you apply all the above ways offers your credit score time to stabilize and strengthen. Think about this a short lived monetary boot camp—one which pays off with higher mortgage phrases, decrease rates of interest, and higher peace of thoughts.

Credit score Progress Is Potential, Even Quick

Elevating your credit score rating doesn’t need to take years. With strategic planning, targeted effort, and some well-timed strikes, 30 days is sufficient to make an actual distinction. These ways work as a result of they leverage how credit score scores are literally calculated, not as a result of they bend the principles. Don’t fall for fast fixes or scams. As a substitute, apply these reliable methods to offer your credit score the enhance it deserves, after which preserve constructing from there.

What’s the neatest transfer you’ve ever made that helped your credit score rating quick?

Learn Extra:

7 Credit score Rating Taboos You Can Break With out Tanking Your FICO

Do You Know Your Companion’s Credit score Rating? Why Consultants Say You Ought to

Riley is an Arizona native with over 9 years of writing expertise. From private finance to journey to digital advertising to popular culture, she’s written about all the pieces below the solar. When she’s not writing, she’s spending her time outdoors, studying, or cuddling along with her two corgis.