Your credit score report could also be probably the most necessary paperwork in your monetary life, nevertheless it’s additionally probably the most misunderstood. Most individuals solely take into consideration their credit score when making use of for a mortgage or getting denied for a bank card. However in actuality, your credit score report performs a task in every little thing from renting an residence to touchdown a job.

Much more shocking? There are issues buried in your credit score report that may have an effect on your monetary life in methods you may by no means have imagined. And in the event you’re not often checking what’s on it or understanding the way it works, you might be setting your self up for pricey errors.

Listed below are 5 eye-opening info about credit score stories that each shopper ought to know. Some may shock you. All of them may allow you to make smarter choices about your cash, beginning at present.

1. Credit score Reviews Are Not the Identical as Credit score Scores

Some of the frequent misconceptions is {that a} credit score report and a credit score rating are interchangeable. They’re not. Your credit score report is an in depth historical past of your borrowing conduct. It consists of data like open accounts, fee historical past, credit score limits, and inquiries. A credit score rating, however, is a numerical illustration, normally starting from 300 to 850, based mostly on the knowledge in your report.

In brief, the report is the uncooked knowledge; the rating is the snapshot.

Why does this matter? As a result of you may have correct, detailed stories—and nonetheless find yourself with a mediocre rating in case your utilization is simply too excessive or your credit score combine is proscribed. Likewise, your rating can drop even when no errors seem in your report, merely as a consequence of algorithmic modifications.

Backside line: in the event you’re solely checking your rating and ignoring your report, you’re lacking the complete image.

2. Employers and Landlords Could Take a look at Your Report—Not Your Rating

Many individuals imagine solely lenders care about credit score stories. However more and more, employers, landlords, and even insurance coverage corporations are checking your credit score report as a part of their decision-making course of. Whereas employers can’t view your precise rating, they will typically request a modified model of your report, along with your permission.

What are they in search of? Crimson flags embody missed funds, massive quantities of debt, or patterns of economic instability. To them, these behaviors may sign a scarcity of duty or reliability, even in the event you’ve by no means defaulted.

This implies your credit score habits may have an effect on your capability to get employed or accepted for a lease, even in the event you by no means plan to take out a mortgage.

3. Credit score Reviews Usually Include Errors, And They Can Be Expensive

In line with the Federal Commerce Fee (FTC), one in 5 shoppers has an error on at the least one in all their credit score stories. These errors can vary from minor points like incorrect addresses to severe inaccuracies like accounts that don’t belong to you or late funds that had been really made on time.

And sure, these errors can damage your credit score rating, even when they aren’t your fault. Inaccurate stories can result in increased rates of interest, mortgage denials, and even missed job alternatives.

The excellent news? You’ve got the best to dispute errors with the credit score bureaus (Equifax, Experian, and TransUnion) for gratis. The unhealthy information? Most individuals don’t even understand they should. In the event you haven’t reviewed your credit score report not too long ago, now’s the time to request your free annual report and scan it line by line.

4. Closing Outdated Accounts Can Harm Your Rating, Not Assist It

It may appear logical to shut outdated or unused bank cards to wash up your funds, however doing so can really injury your credit score rating. Right here’s why: a part of your rating is set by your credit score utilization ratio, which compares your bank card balances to your whole out there credit score. Shut an account, and also you cut back your whole out there credit score, presumably driving your utilization increased even when your spending stays the identical.

Additionally, the size of your credit score historical past issues. The longer you’ve had credit score, the higher. Closing an outdated account erases that longevity out of your energetic profile, particularly if it was one in all your oldest strains.

Until you’re paying an annual payment for a card you not use, it’s typically higher to go away outdated accounts open, even in the event you hardly ever contact them.

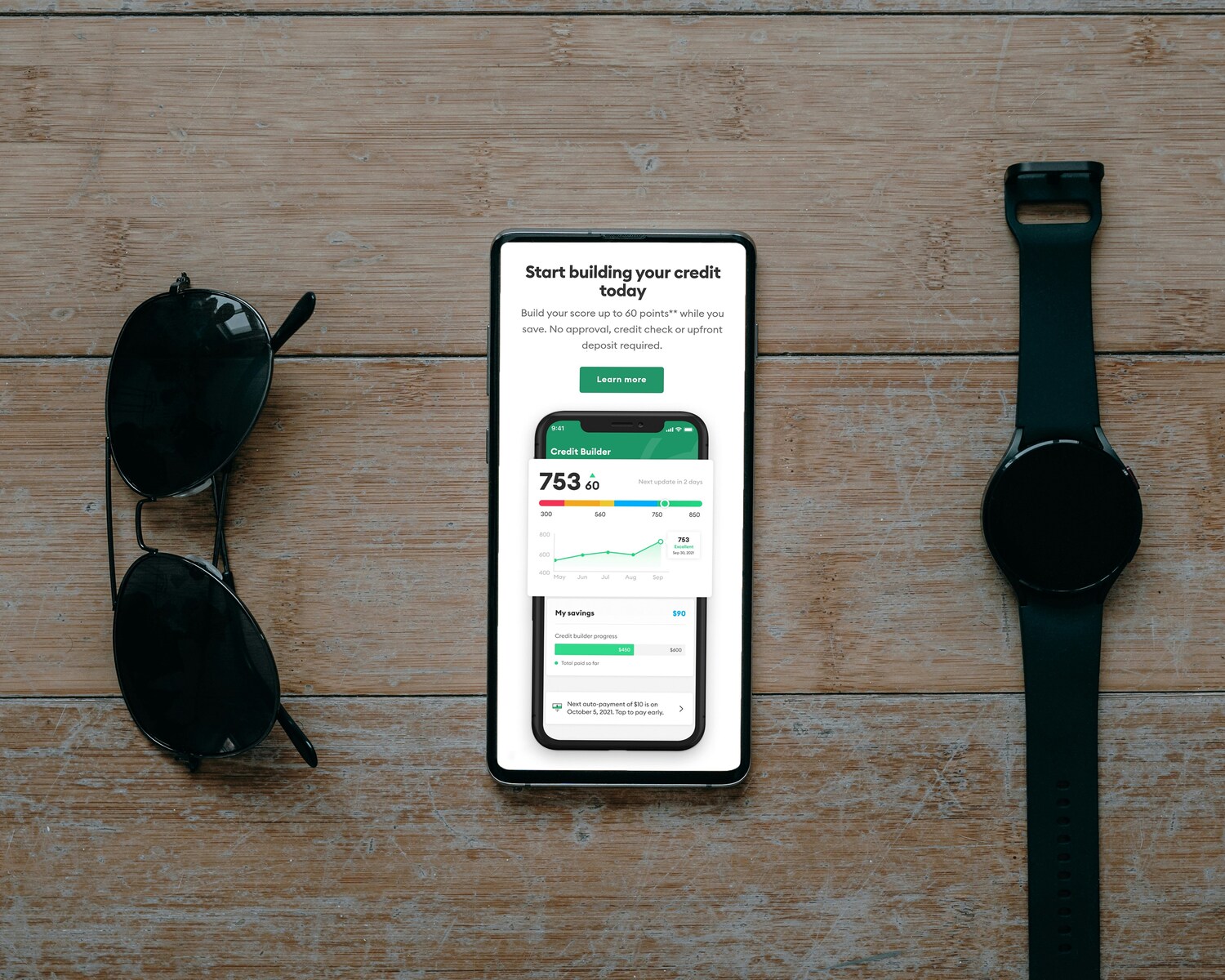

5. You Don’t Have to Be in Debt to Construct Good Credit score

Many individuals mistakenly imagine they should carry debt to construct credit score. In actuality, what issues most is how you utilize credit score, not whether or not you carry balances. Paying off your bank cards in full every month nonetheless helps your rating, so long as the account is energetic and you utilize it often.

What actually hurts your credit score is making late funds, maxing out playing cards, or making use of for too many accounts in a short while. Accountable, constant use, even of a single card, can steadily enhance your rating over time.

So, in the event you’ve been avoiding credit score since you don’t need debt, relaxation assured: you may be debt-free and credit-strong on the similar time.

Why Your Credit score Report Issues

Your credit score report is greater than only a formality. It’s a monetary biography that lenders, employers, landlords, and even insurers might use to make choices about you. Sadly, most individuals don’t understand how a lot energy it holds till it’s too late. Whether or not it’s recognizing errors, avoiding frequent credit score myths, or understanding how your habits have an effect on your future, taking management of your credit score report is without doubt one of the smartest monetary strikes you can also make.

The reality is, understanding your credit score isn’t nearly numbers—it’s about realizing how these numbers have an effect on your actual life. And now that you realize what to look out for, you may take motion with readability and confidence.

When was the final time you checked your credit score report, and had been you stunned by what you discovered?

Learn Extra:

Intelligent Methods to Increase Your Credit score Rating in 30 Days

Why People Now Brag About Credit score Card Limits As a substitute of Financial savings

Riley is an Arizona native with over 9 years of writing expertise. From private finance to journey to digital advertising to popular culture, she’s written about every little thing below the solar. When she’s not writing, she’s spending her time outdoors, studying, or cuddling together with her two corgis.