Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of prime tales throughout U.S. hours and an outline of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Telegram’s blockbuster cope with xAI, which might see Elon Musk’s AI firm combine into Telegram and the 2 corporations share income, continues to be a piece in progress regardless of an announcement from Pavel Durov earlier Wednesday, U.S. time, that the deal was inked.

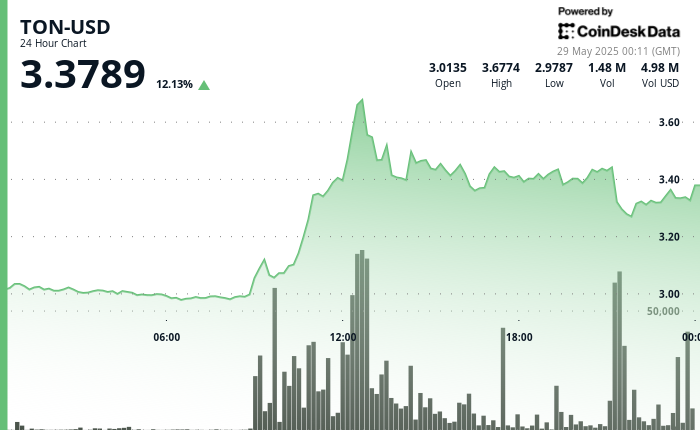

TON, a token affiliated with Telegram’s ecosystem, is buying and selling at $3.30, rallying there from $3 after the preliminary – now refuted – announcement of the partnership was made. The token is down from an earlier excessive of $3.68, after Elon Musk posted on X that no deal had been signed between the 2 firms. TON continues to be up 11% on the day, in line with CoinDesk market information.

Whereas Durov has now confirmed that no deal has been signed, the Telegram founder mentioned there may be an “settlement in precept” which is perhaps why TON nonetheless has important help on the $3.30.

All eyes will probably be on Telegram and xAI because the Asia enterprise day begins to see if extra clarification comes from both facet.

Decentralized BlueSky is not a Web3 Firm, Says CEO

VANCOUVER—Jay Graber, the CEO of fast-growing decentralized social media platform Bluesky, acquired her begin in Web3 as a developer for privateness coin zCash, however she desires to maintain her X competitor firmly in Web2.

Talking at Net Summit in Vancouver on Wednesday, Graber argued blockchain expertise’s permanence and resource-intensive design make it unsuitable for consumer-oriented social networks, the place content material is fleeting and private.

“Why do you want your image of what you publish for lunch being maintained ceaselessly on this digital archive?” she requested on stage, highlighting the inherent scalability and value limitations that drove her determination to keep away from blockchain at Bluesky.

Graber, to make certain, is not in opposition to crypto. She says there’s nonetheless real worth within the expertise for issues like funds and digital id, even when generally Web3 usually presents options searching for an issue, and has a development of gravitating in the direction of centralization.

“There’s a interval the place everybody was creating blockchain like this hammer, and we have been simply going to attempt blockchain for all the pieces,” Graber mentioned. “Each system that is making an attempt to do it finally ends up with concentrations as a result of it is simple, and comfort in the end wins on the finish of the day.”

For her, Bluesky’s future lies in combining the beliefs of decentralization, comparable to consumer autonomy and portability, with sensible, Web2 infrastructure to create a platform that prioritizes customers’ wants.

“Blockchain will most likely discover its place someplace on the earth of expertise, however Bluesky just isn’t on a blockchain as a result of we’re simply making the most effective selections for our customers,” she concluded.

Nvidia’s Earnings Beat Boosts Inventory, Gives Modest Elevate to AI Tokens

Shares of Nvidia rose roughly 4% in after-hours buying and selling Wednesday after reporting stronger-than-expected first-quarter earnings, highlighted by a 69% income enhance from final 12 months and a 73% soar in its information middle enterprise pushed by strong demand for AI chips. Internet revenue rose 26% to $18.8 billion, boosting Nvidia’s year-to-date efficiency modestly increased, CoinDesk beforehand reported.

The earnings report supplied a slight elevate to AI-related crypto tokens like Bittensor (TAO), NEAR Protocol, and Web Laptop (ICP), although positive aspects have been modest.

Nevertheless, Nvidia tempered future expectations, cautioning that second-quarter income may fall wanting market estimates attributable to tariff-related commerce tensions between the U.S. and China.

Market Actions:

- BTC: Bitcoin dipped 1.2% to $107,800, although NYDIG sees extra room for positive aspects. On the similar time, crypto markets shrugged off a U.S. court docket blocking Trump’s broad tariffs as unconstitutional, with BTC buying and selling remaining muted.

- ETH: Ether is buying and selling above $2700 as Asia begins its enterprise day. Earlier, CoinDesk analyst Omkar Godbole wrote ETH is eying a breakout above $3,000, forming a bullish “ascending triangle” sample with rising help and resistance at $2,735, as increased lows sign rising shopping for strain and accumulation forward of a possible worth surge.

- Gold: Gold has slipped 1% to $3,267.47 amid cooling safe-haven demand, although tariff and geopolitical uncertainty linger.

- Nikkei 225: The Nikkei 225 is opening within the inexperienced, up 1%, as traders in export-reliant Japan are taking a look at a latest announcement that the Supreme Courtroom has blocked Trump’s tariffs with cautious optimism, at the same time as crypto shrugged it off.

- S&P 500: Whereas the S&P 500 closed within the crimson, futures are up 1% as merchants await extra readability relating to the court docket’s transfer to dam Trump’s tariffs.