Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Soccer value of the lion and gamers some tender. Every arcu lorem, ultricies any youngsters or, ullamcorper soccer hate.

This text can be accessible in Spanish.

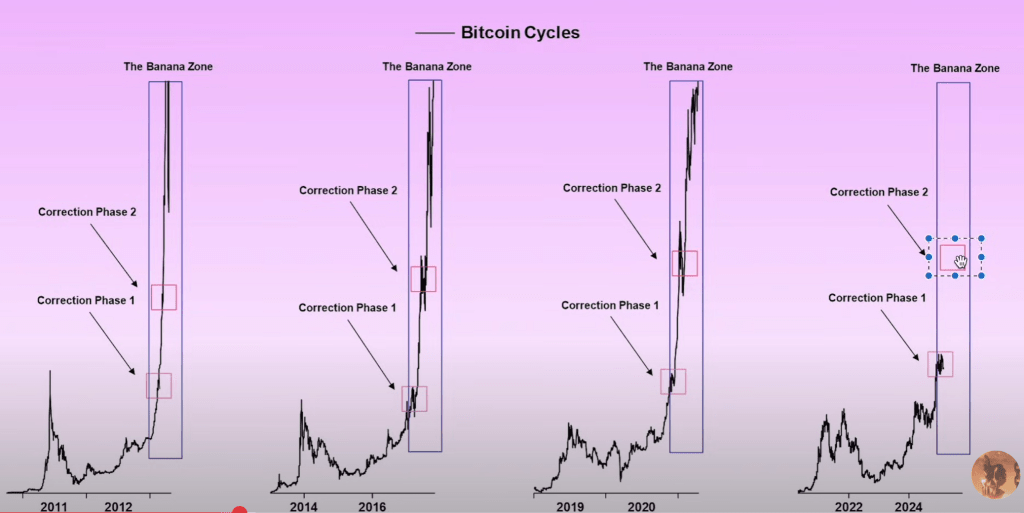

In a market replace, distinguished crypto commentator Rekt Capital examined Bitcoin’s newest dip by the lens of earlier bull cycles, asserting that it intently resembles the 2017 sample of a number of corrections en path to a parabolic high. Talking in a video titled “The place’s The Bitcoin ‘Banana Zone’? – An Replace,” the analyst referred to the “banana zone” as “successfully a time period of endearment for the parabolic section of the cycle on the subject of Bitcoin’s value motion.” He described the present retracement as a pure however prolonged correction, emphasizing that it’s “nonetheless on observe” regardless of many merchants feeling discouraged.

Will Bitcoin Enter ‘The Banana Zone’ Once more?

Rekt Capital drew parallels between the current dip and historic market habits, spotlighting the cyclical tendency for Bitcoin to expertise two or extra corrective durations as soon as it breaks into new all-time highs. Citing the 2017 rally, he famous that there have been situations of “34% to 38% to 40%” pullbacks, no less than 4 in whole, earlier than the final word peak was reached.

He additionally referenced 2013’s bumpy ascents and traced them towards at this time’s value motion, explaining that “once we break to new all-time highs, it may possibly get just a little bit bumpy” each round previous highs and instantly following new ones. Regardless of the present drawdown of 32% (max peak), he maintained that “we’re going to see extra upside after this corrective interval like we’ve seen prior to now” and labeled the market’s current place as a part of the primary of two possible corrections within the present value discovery section.

Associated Studying

All through his evaluation, Rekt Capital underscored the significance of endurance, noting that what would possibly really feel like a protracted drawdown will not be “out of the extraordinary” for Bitcoin which traditionally endures a number of phases of uptrends and retracements on its strategy to a peak. “What’s out of the extraordinary,” he mentioned, “is that it’s taking longer, but it surely’s going to allow that subsequent value discovery uptrend sooner or later.”

He supplied historic context by trying again at mid-2017 and different phases when Bitcoin underwent repeated downturns that ranged from round 30% to 40%. In keeping with him, these corrections typically deepen because the cycle progresses, though the ultimate one earlier than the following main transfer can generally be shallower.

The analyst additionally delved into technical indicators such because the 21-week and 50-week exponential transferring averages, suggesting that Bitcoin’s value has begun forming a triangular market construction because it turns into “sandwiched in between the 21-week EMA and the 50-week EMA.”

He drew comparisons to the mid-2021 interval, when an analogous formation preceded a 55% draw back transfer that finally broke out into one other bullish section. “We ended that interval with a weekly shut and post-breakout retest of the 21-week EMA into assist,” he recounted, predicting {that a} comparable scenario may see Bitcoin rally towards the $93,500 degree if the transfer above the 21-week EMA holds.

Associated Studying

In addressing considerations that the market is getting into a bear cycle, Rekt Capital asserted that “it’s not a bear market like everyone is saying.” Whereas he acknowledged the emotional toll of enormous pullbacks and the prevalence of conflicting alerts within the media, he suggested preserving a degree head and specializing in robust indications comparable to moving-average confluence, historic correction ranges, and the truth that “we’re on this first value discovery correction” somewhat than any last downturn. In keeping with his outlook, the crypto’s value remains to be following the overarching blueprint set by earlier bull runs, even whether it is “just a little little bit of a deep one” and has disenchanted merchants hoping for extra rapid parabolic momentum.

Rekt Capital concluded his commentary by stressing reaccumulation phases are a part of an enduring bull-market framework somewhat than the onset of a protracted downtrend.

At press time, BTC traded at $85,914.

Featured picture created with DALL.E, chart from TradingView.com