Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Soccer value of the lion and gamers some tender. Every arcu lorem, ultricies any children or, ullamcorper soccer hate.

This text can be obtainable in Spanish.

In line with a latest CryptoQuant Quicktake put up, whereas Bitcoin (BTC) has seen a gentle rise in value from November 2024 to February 2025, sentiment within the cryptocurrency’s futures market has not proven a corresponding uptick.

Bitcoin Futures Sentiment Index Alerts Warning

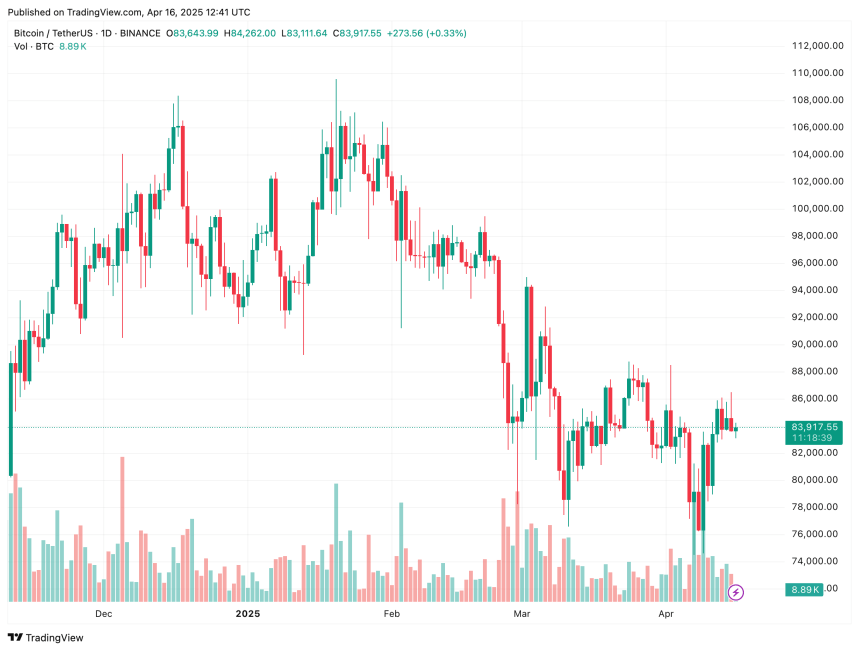

Bitcoin’s value surged from roughly $74,000 in November 2024 to a peak of $101,000 by early February 2025. Nonetheless, following US President Donald Trump’s tariff bulletins, risk-on belongings – together with BTC -have skilled a big pullback.

Associated Studying

After hitting a possible native backside of $74,508 earlier this month on April 6, the apex cryptocurrency has recovered a few of its latest losses. The highest digital asset is buying and selling within the mid $80,000 vary on the time of writing.

Regardless of this restoration, BTC’s futures sentiment has continued to say no since February. Whilst the worth holds close to native highs, sentiment within the futures market has notably cooled.

CryptoQuant contributor abramchart highlighted this divergence, noting that it might point out rising warning or profit-taking habits regardless of the continuing bullish development. The analyst commented:

This means a cooling curiosity or elevated concern within the futures market, probably on account of macroeconomic uncertainty, regulatory issues, or anticipated corrections.

A take a look at the BTC futures sentiment index exhibits a resistance zone round 0.8 and a assist degree close to 0.2. The index is presently hovering round 0.4, pointing to a predominantly bearish sentiment throughout futures markets.

Equally, Bitcoin’s common value has steadily declined from its early 2025 highs. It’s now ranging between $70,000 and $80,000, signalling potential market indecision amid heightened tariff tensions.

In line with abramchart, if futures sentiment stays low, BTC might face prolonged value consolidation and even downward strain within the close to time period. Nonetheless, any rising bullish catalyst might shortly shift the sentiment and renew upward momentum.

Is BTC Shut To A Momentum Shift?

Some analysts consider Bitcoin could also be nearing a breakout. After consolidating within the mid-$80,000s for a number of weeks, on-chain metrics counsel BTC could also be undervalued at present ranges. Indicators comparable to BTC alternate reserves and the Stablecoin Provide Ratio assist this view.

Associated Studying

As well as, momentum indicators like Bitcoin’s weekly Relative Energy Index have begun to interrupt out of a long-standing downward trendline – elevating hopes for a possible bullish rally again towards $100,000.

Nonetheless, a number of dangers nonetheless stay. The latest look of a ‘loss of life cross’ on BTC’s value chart – mixed with persistent macroeconomic issues associated to commerce tariffs – might nonetheless weigh closely on market sentiment. At press time, BTC trades at $83,917, down 1.8% over the previous 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant and TradingView.com