Bitcoin’s fast value rally has caught merchants off guard, triggering massive liquidations of bearish quick positions.

The main cryptocurrency by market worth has risen over 3% to $102,500 previously 24 hours, with costs topping $104,000 at one level, the very best since Jan. 31. The bullish transfer got here as President Donald Trump introduced a complete commerce cope with the U.Okay. and the cumulative inflows into the spot exchange-traded funds (ETFs) hit a report excessive above $40 billion.

The broader market rallied as properly, with the whole market cap of all cash excluding BTC surging by 10% to $1.14 trillion, the very best since March 6, in line with information supply TradingView.

That has led to substantial liquidations of bearish quick positions, or leveraged performs geared toward making the most of value losses. A place is liquidated or compelled closed when the dealer’s account stability falls beneath the required margin stage, usually attributable to opposed value actions. This leads the trade to shut the place to forestall additional losses mechanically.

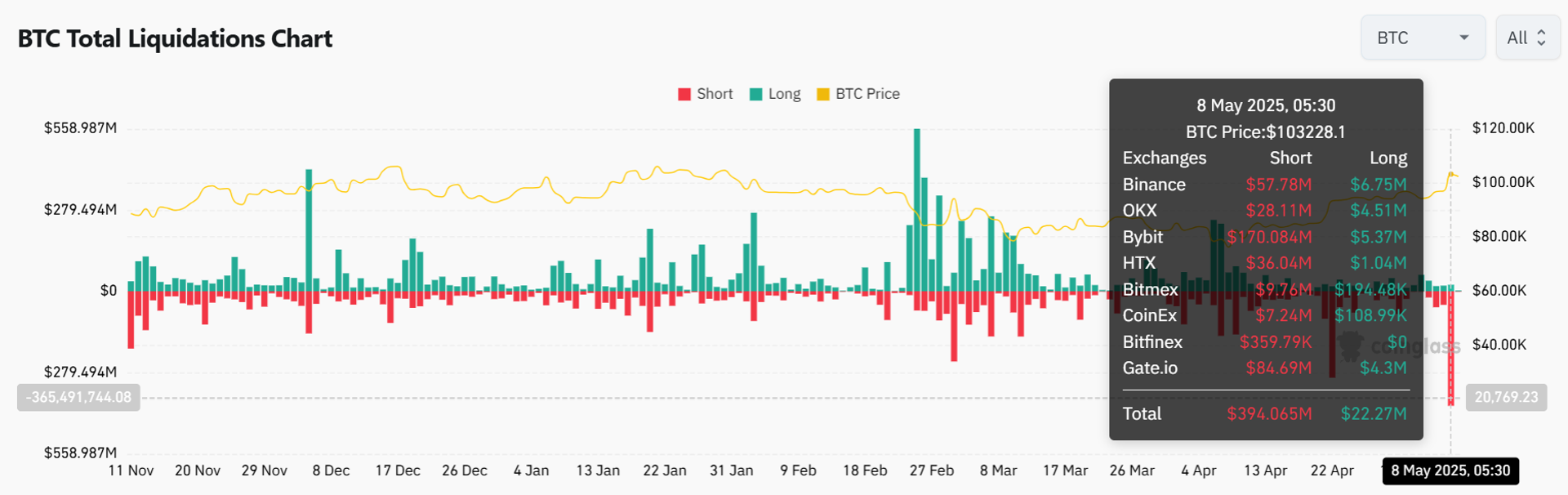

Practically $400 million in BTC quick positions had been liquidated previously 24 hours—marking the very best single-day whole since not less than November, in line with Coinglass. In the meantime, $22 million in lengthy positions had been additionally worn out.

This important imbalance signifies that leverage was closely tilted in the direction of the bearish facet, and the fast liquidation of shorts suggests there may very well be extra upside potential for the market forward.