Cardano’s is there

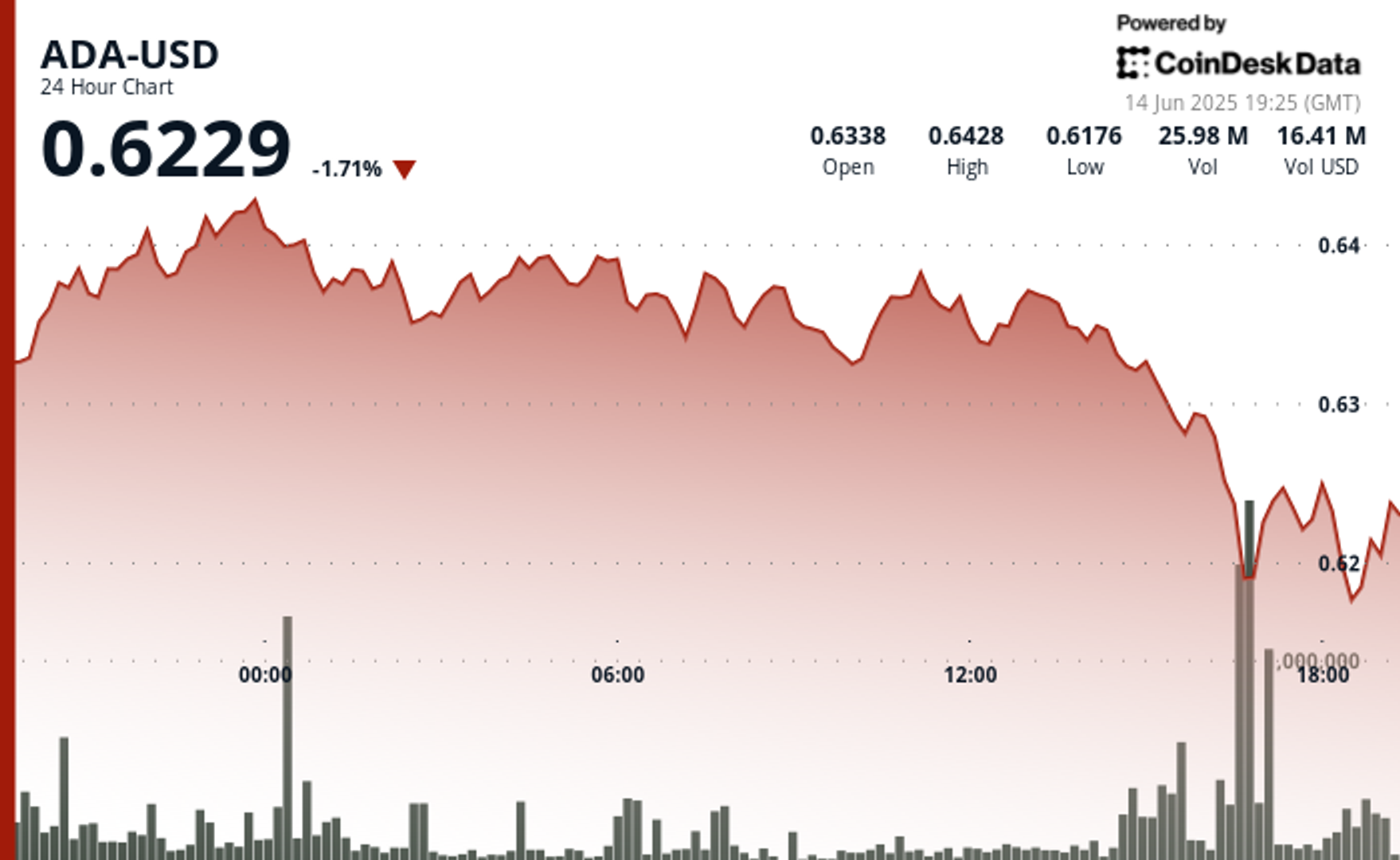

was down 1.71% over the previous 24 hours, buying and selling at $0.6229 as of June 14. The asset briefly slipped to $0.6176 earlier than stabilizing, holding its footing regardless of a pointy wave of promoting from giant holders.

In accordance with current market knowledge, whales have offloaded over 270 million ADA —value roughly $170 million — in a transfer that has added vital stress to the token’s worth motion throughout every week marked by geopolitical volatility.

But, amid the sell-off, the Cardano Basis unveiled a brand new product aimed toward enterprise adoption. On Thursday, the group launched Originate, a blockchain-based answer for verifying product origin and authenticity. Designed to assist companies streamline compliance and shield in opposition to counterfeits, Originate permits corporations to digitize and observe crucial product knowledge on-chain, enabling prompt verification by customers and regulators.

On its web site, the Basis emphasised that Originate is constructed to strengthen model belief in industries the place provide chain transparency is crucial. By positioning itself as a instrument for regulatory compliance and shopper assurance, the product could assist bolster Cardano’s status in enterprise circles —particularly at a time when buyers are looking for real-world use circumstances past DeFi and staking.

The announcement comes simply days after ADA was added to the Nasdaq Crypto Index, becoming a member of Bitcoin and Ethereum. Whereas short-term sentiment stays fragile as a result of whale conduct and broader risk-off macro tendencies, Cardano’s increasing institutional profile might present longer-term assist.

Technical Evaluation Highlights

- ADA ranged between $0.6176 and $0.6428, closing close to $0.6229, a 1.71% every day loss.

- Resistance stays robust close to $0.642–$0.645, whereas worth broke under assist at $0.636.

- Heaviest quantity spikes occurred after 18:00 GMT as worth dipped under $0.62, triggering transient sell-off adopted by consolidation.

- Development stays bearish with decrease highs forming all through the day, and rejection at $0.635.

- Value motion suggests near-term stabilization, however whales stay dominant in setting market route

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.