Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Soccer value of the lion and gamers some comfortable. Every arcu lorem, ultricies any children or, ullamcorper soccer hate.

This text can also be accessible in Spanish.

Based on a latest CryptoQuant Quicktake put up by on-chain analyst BorisVest, Ethereum (ETH) seems to be caught in a state of limbo. Whereas retail traders are more and more sending ETH to exchanges corresponding to Binance – sometimes an indication of promoting stress – massive traders are steadily withdrawing ETH from these platforms, indicating accumulation and long-term confidence.

Ethereum Caught In A Tug-Of-Warfare

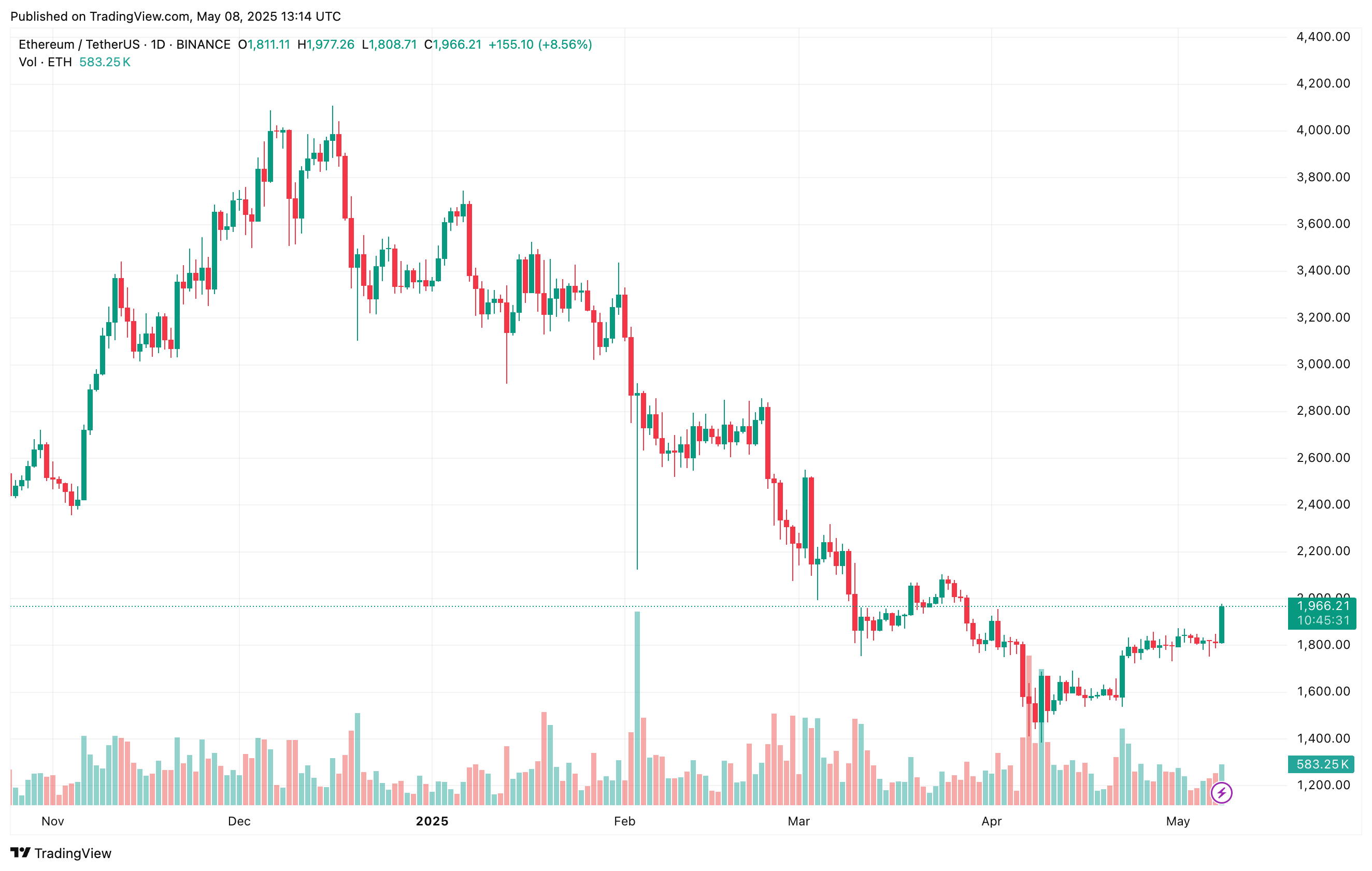

As ETH inches nearer to the $2,000 mark for the primary time since March 27, market sentiment seems to be shifting. Optimism is constructing across the potential for a development reversal, however on-chain information continues to ship combined indicators relating to Ethereum’s short- to medium-term path.

Associated Studying

In his evaluation, BorisVest highlighted that Ethereum metrics from Binance are sending ‘combined indicators.’ Whereas short-term indicators reveal underlying weak spot and investor indecision, longer-term metrics level to resilience and energy.

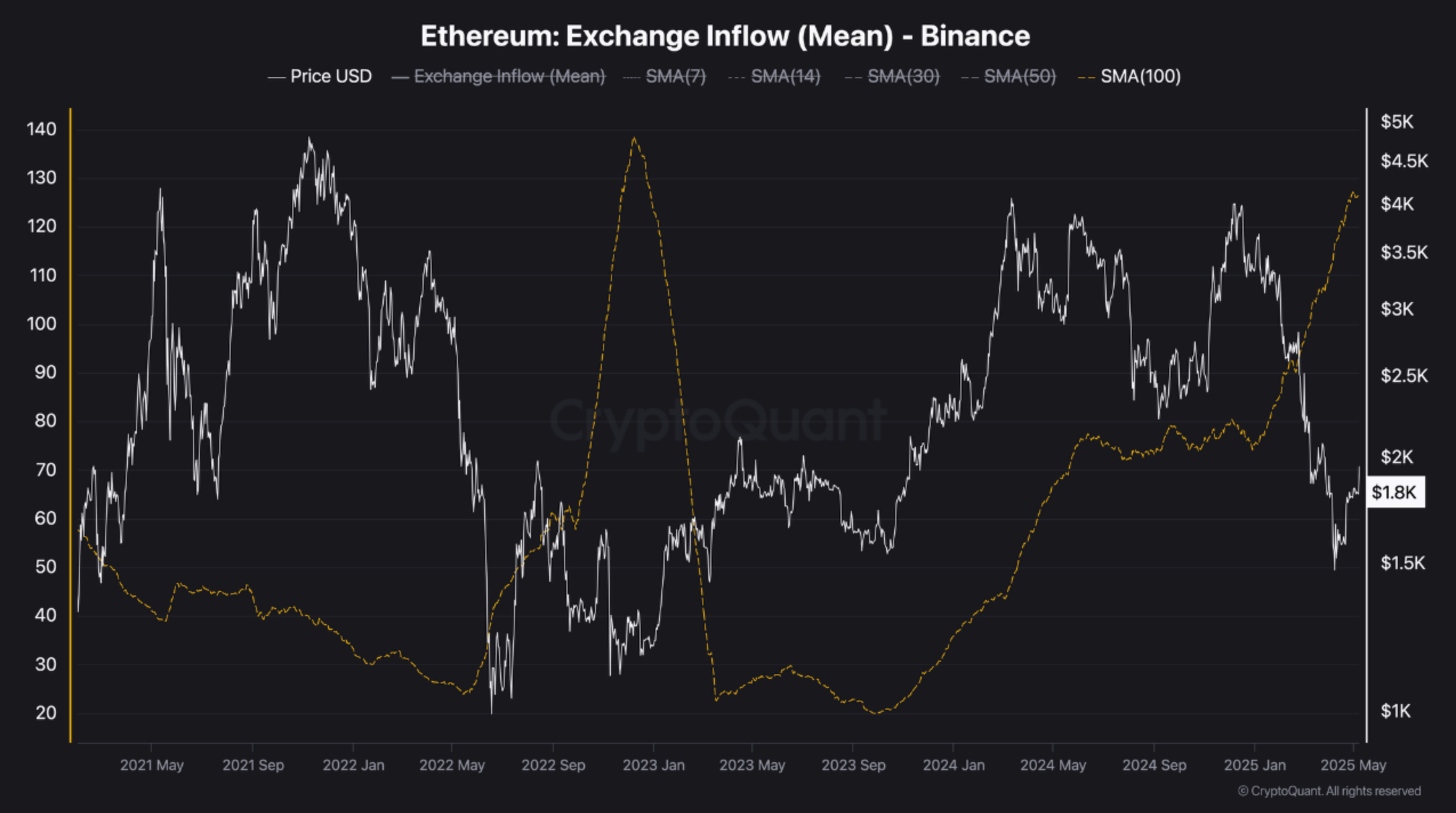

Notably, imply alternate inflows have elevated considerably since late 2024, suggesting rising promote stress from retail merchants. This sample resembles the conduct seen throughout 2022–2023, when a surge in ETH deposits to exchanges preceded a steep value decline.

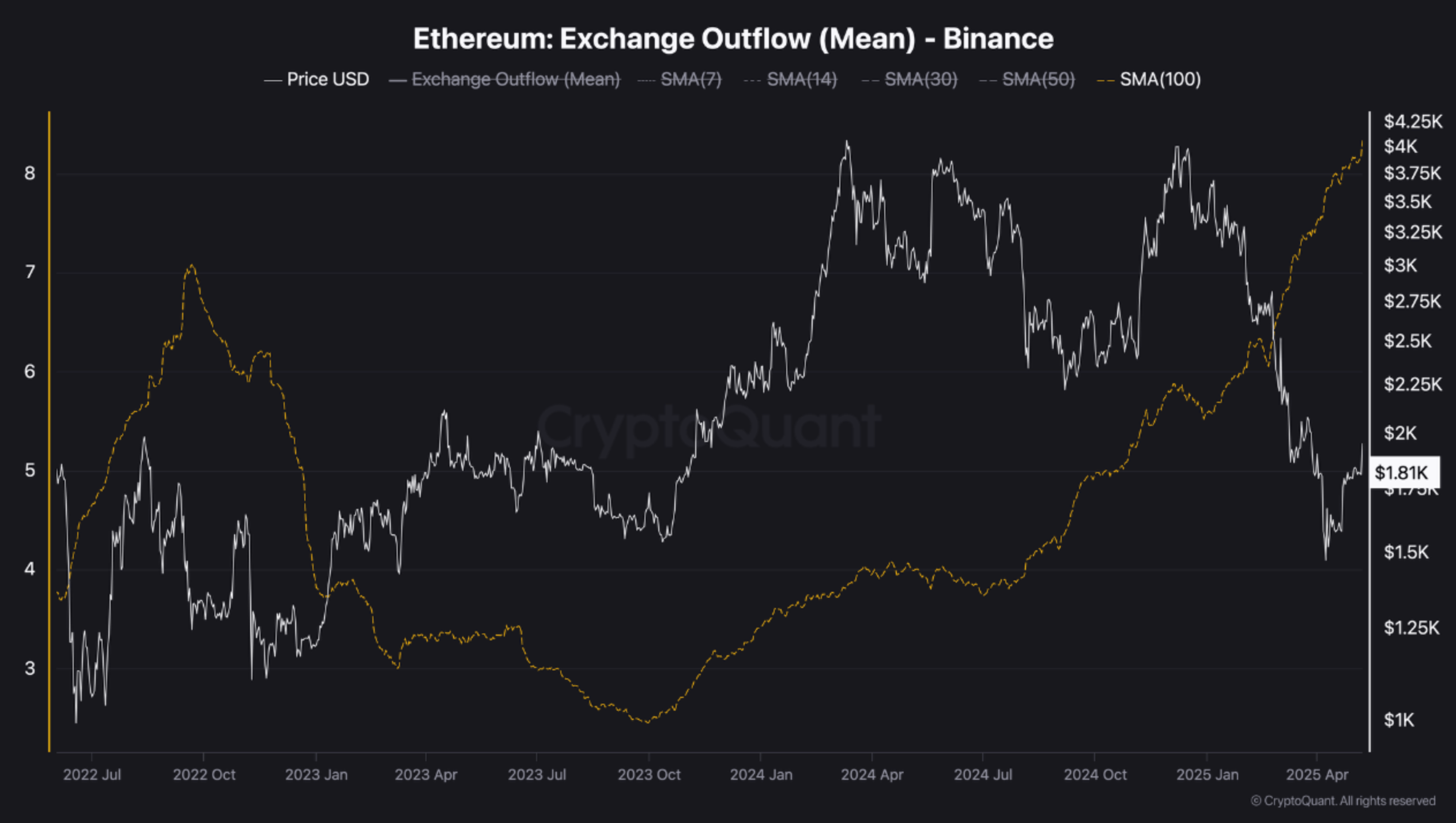

Equally, imply alternate outflows have additionally been rising steadily since October 2023. Nonetheless, these outflows are largely linked to whale wallets – addresses holding massive quantities of ETH – implying that high-net-worth people are accumulating fairly than promoting. This divergence highlights a traditional tug-of-war between retail concern and institutional confidence.

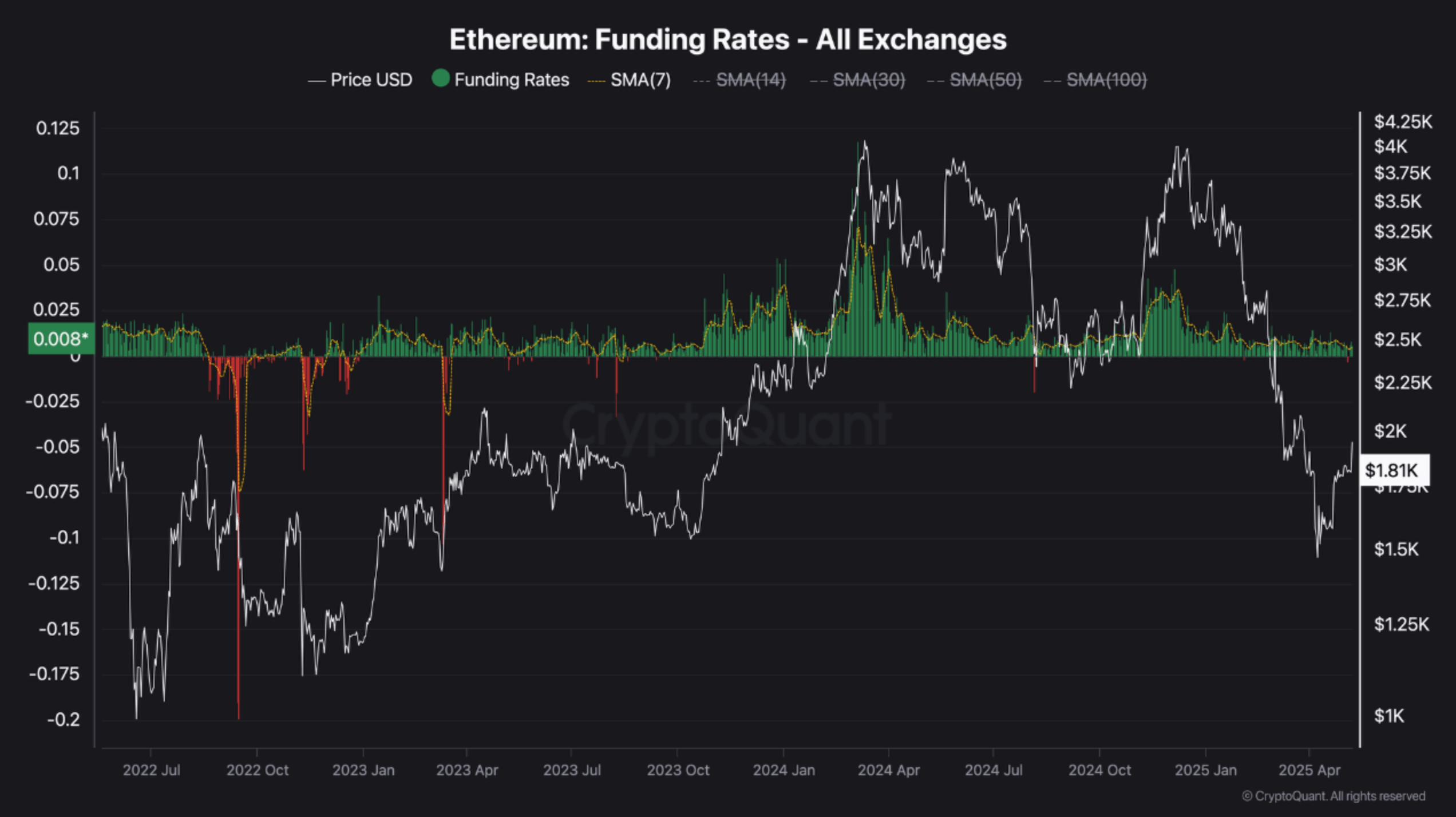

The analyst additionally pointed to funding charge developments. He famous that in ETH’s rally to $4,000 in early 2025, funding charges grew to become overly constructive as bullish sentiment took maintain. This over-leveraged lengthy positioning resulted in a pointy correction, driving ETH’s value right down to $1,400 by April.

At current, funding charges are hovering in impartial territory, indicating a scarcity of clear leverage bias. BorisVest famous that if quick curiosity rises and funding charges fall beneath zero, a brief squeeze may ensue – doubtlessly driving costs larger. Nonetheless, no such setup has fashioned but.

In the meantime, the taker purchase/promote ratio, which tracks aggressive market orders, confirmed heavy promoting stress in late 2024 and early 2025 – proper earlier than Ethereum’s steep decline. This ratio is now stabilizing, suggesting that sellers could also be exhausted and patrons are progressively regaining energy.

Change Of Fortunes For ETH?

Though ETH is down 34.3% over the previous 12 months, a number of technical and on-chain indicators level towards a possible bullish development reversal for the second-largest cryptocurrency by market cap.

Associated Studying

As an example, Ethereum not too long ago flashed a golden cross on the each day chart, a bullish indicator that sometimes results in main upward strikes. Additional, there are indicators that the cryptocurrency could have already bottomed out for this market cycle.

That mentioned, uncertainty stays. Just lately, machine studying algorithm CoinCodex predicted that ETH could witness one other crash that will push its value right down to $1,500. At press time, ETH trades at $1,966, up 7.8% prior to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant and TradingView.com