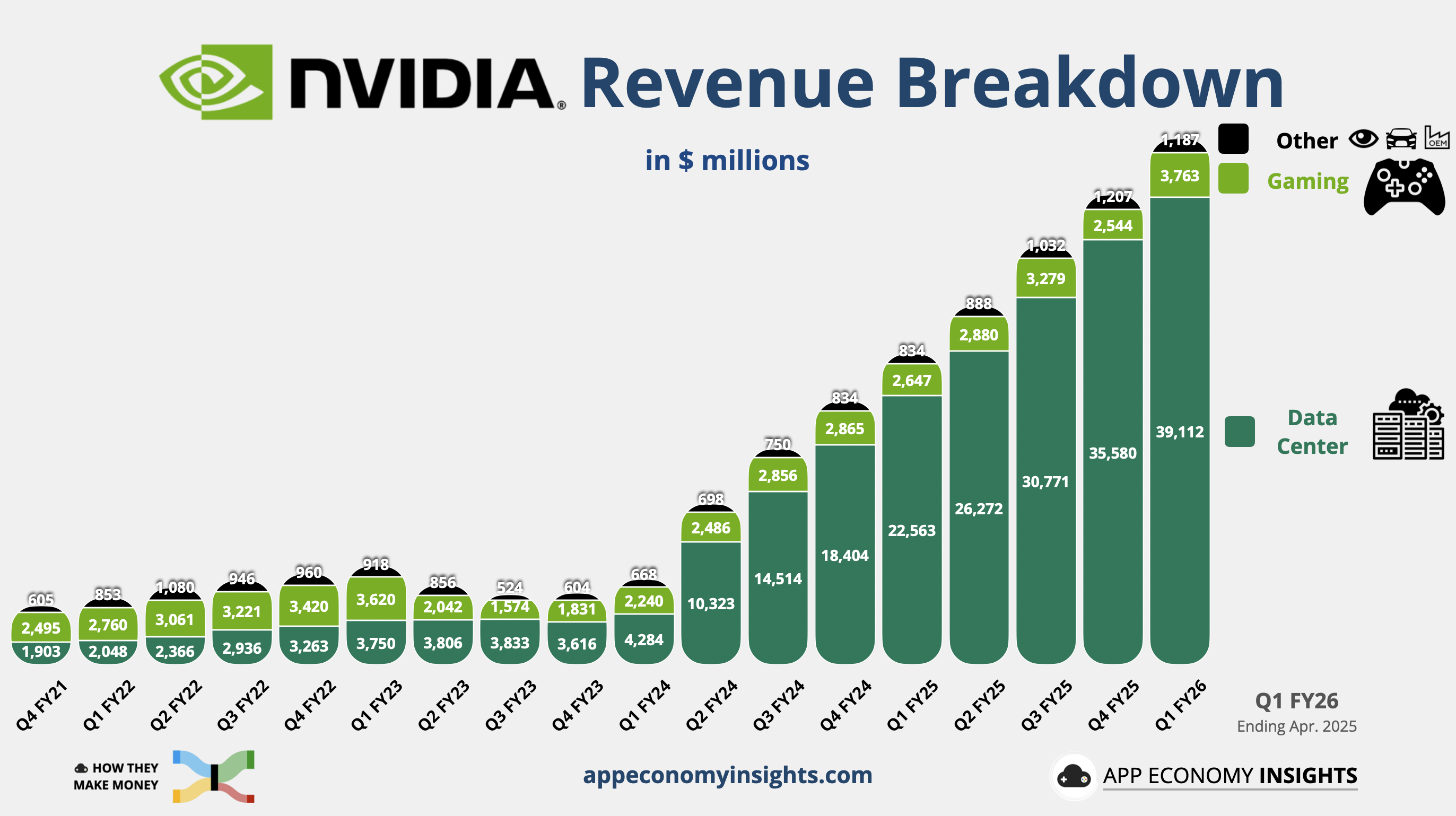

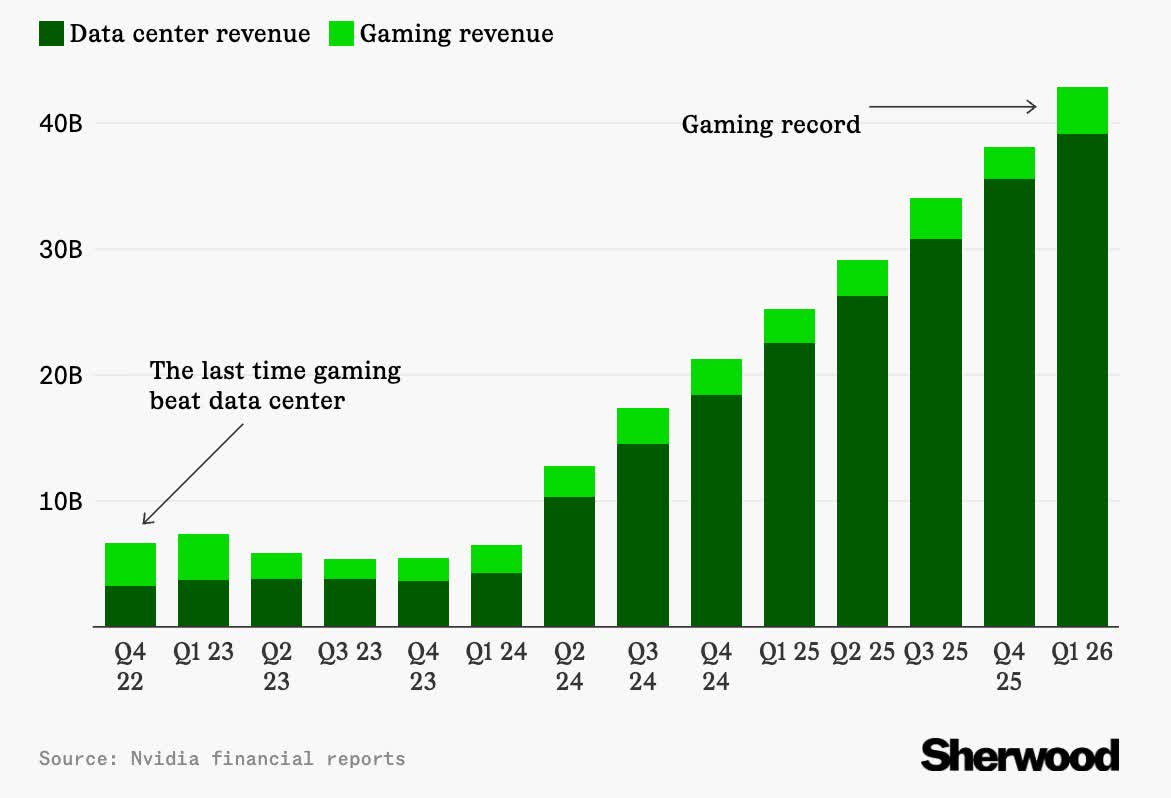

Massive quote: Nvidia has been raking in record-breaking income from its AI information heart enterprise. However this time it was the gaming division that unexpectedly stole among the highlight. For Q1 FY26, Nvidia’s gaming income surged to a report $3.8 billion, up 42% year-over-year and 48% quarter-over-quarter. That is the quickest development price the gaming GPU phase has seen in years, and even exceeding Wall Avenue’s expectations by over 30%.

As for what’s behind the surge, analysts says it is all bought to do with Nvidia’s “Blackwell ramp.” The brand new GPUs could also be rolling out quicker than any technology earlier than, which the corporate claims presents huge efficiency positive aspects, particularly when mixed with DLSS and Multi-Body Era (MFG). Nonetheless, our benchmark information paints a extra tempered image. Actual-world efficiency enhancements are far much less dramatic than Nvidia’s advertising suggests.

One other neglected issue behind gaming income development could be the rising diversion of high-end shopper GPUs into small-scale AI operations. As demand for AI compute spreads past massive information facilities to startups and unbiased builders, some gaming-class GPUs – particularly higher-end RTX playing cards – are being repurposed for machine studying workloads.

This development inflates gross sales figures however reduces the precise variety of GPUs reaching conventional avid gamers, contributing to greater costs and shortage for shoppers regardless of what seems to be sturdy market efficiency.

It is price noting that even with this banner quarter, gaming accounts for simply 8.5% of Nvidia’s complete income. That is a stark drop from early 2022, when gaming made up 45%. The decline is not because of weak point in gaming – it is as a result of AI has far outgrown it.

In the identical quarter, Nvidia’s complete income hit $44.1 billion, with $39.1 billion of that coming from the information heart phase.

That is practically a 10x development price over gaming in comparison with the identical quarter from two years in the past and up 73% year-over-year. So it is no shock that CEO Jensen Huang in March stated that Nvidia is now an AI infrastructure supplier. That stated, $3.8 billion in gaming income is under no circumstances a small determine and remains to be bigger than many whole firms.

Not the whole lot is clean, although. The quarter got here with a $4.5 billion write-down because of US export restrictions on high-end chips to China. Nvidia additionally warned of an $8 billion income hit in Q2 due to the identical subject.

Within the earnings name, Huang did not mince phrases when he stated that US chipmakers have successfully misplaced entry to China’s AI market. Whereas that is directionally correct, it is not solely the case – quite a few reviews counsel GPUs routed by means of different areas finally find yourself in China.

Huang additionally warned that Chinese language opponents are stepping as much as fill the hole. “Export restrictions have spurred China’s innovation and scale. The AI race isn’t just about chips. It is about which stack the world runs on,” he said. A Chinese language startup based in 2021 is reportedly getting ready to mass-produce a GPU based mostly by itself structure, with efficiency rumored to rival Nvidia’s RTX 4060.

Picture credit score: App Economic system Insights, Sherwood Media