The massive image: Nvidia got here inside hanging distance of setting a brand new report for essentially the most worthwhile firm in historical past on Thursday, as its market capitalization soared to $3.92 trillion throughout intraday buying and selling, simply shy of the $4 trillion mark. The chipmaker’s speedy ascent, fueled by relentless demand for its superior AI chips, briefly pushed it previous Apple’s earlier report closing worth of $3.915 trillion set in late 2024. By the tip of the buying and selling session, Nvidia’s worth settled at $3.89 trillion, barely beneath the all-time excessive however nonetheless underscoring its extraordinary run.

“When the primary firm crossed a trillion {dollars}, it was superb. And now you are speaking 4 trillion, which is simply unimaginable. It tells you that there is this enormous rush with AI spending and all people’s chasing it proper now,” Joe Saluzzi, co-manager of buying and selling at Themis Buying and selling, instructed Reuters.

The surge in Nvidia’s inventory displays a broader wave of optimism on Wall Road about the way forward for AI. The corporate’s newest chips have change into important for coaching and operating the most important and most subtle AI fashions, fueling a race amongst expertise giants to construct highly effective information facilities and dominate the subsequent period of computing. Microsoft, Amazon, Meta, Alphabet, and Tesla are all competing to increase their AI infrastructure, and Nvidia’s specialised {hardware} sits on the coronary heart of this transformation.

In keeping with LSEG information, Nvidia’s present valuation now exceeds the mixed market capitalization of all publicly listed corporations in Canada and Mexico, and even surpasses the overall worth of all publicly traded corporations in the UK.

4 years in the past, the corporate was valued at $500 billion and was largely recognized for its graphics expertise utilized in video video games. Since then, its market capitalization has grown practically eightfold, propelled by the explosive progress in AI purposes and the corporate’s potential to ship the high-performance chips that energy them.

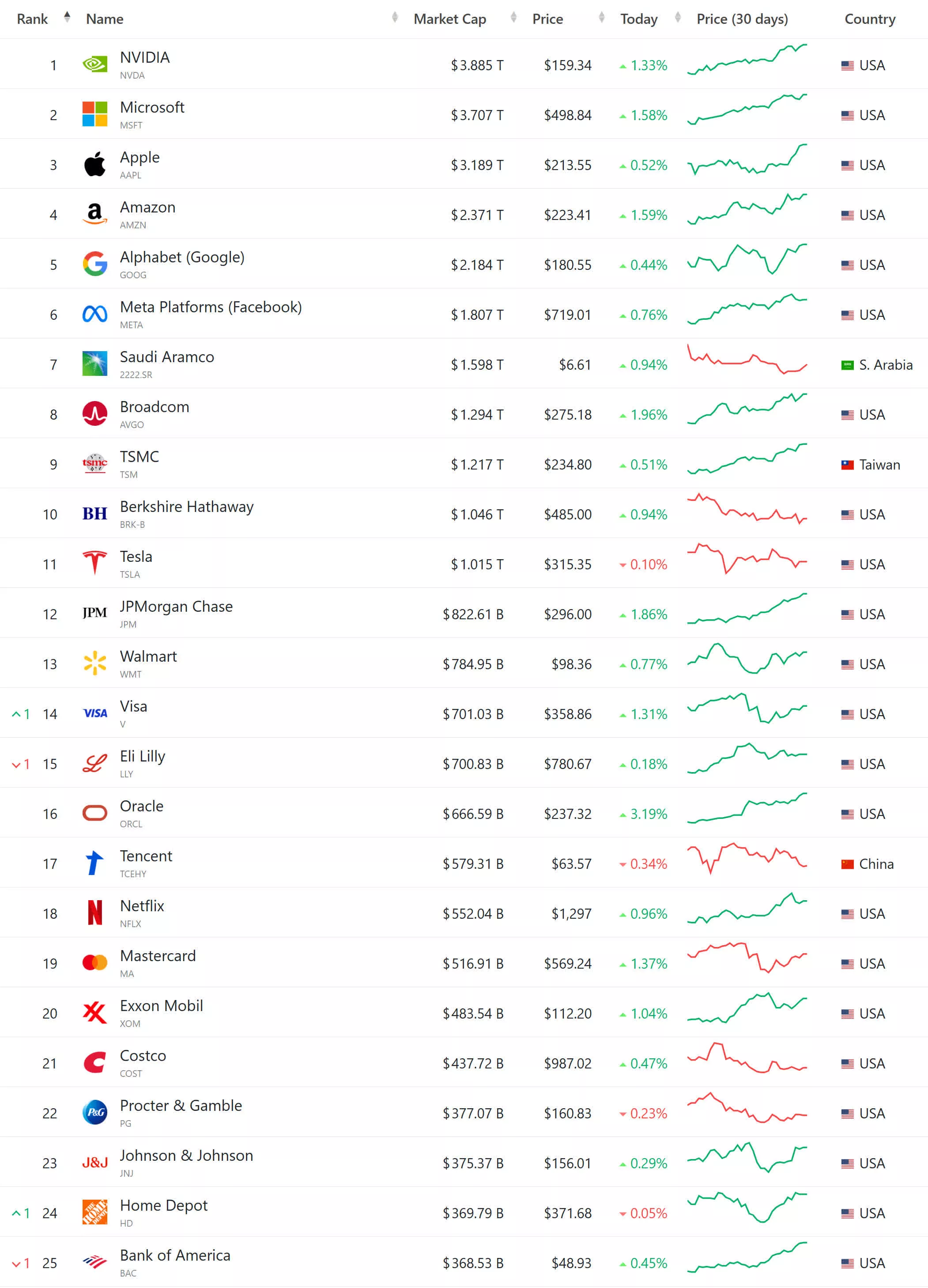

Credit score: Firms by Marketcap

The corporate’s monetary efficiency has been equally spectacular. In the newest quarter, Nvidia reported $44.1 billion in income, a 69 % enhance from the earlier 12 months, with information heart gross sales alone contributing $39.1 billion. This places Nvidia on monitor to method $170 billion in annual income for fiscal 2026, up from $130.5 billion in 2025.

Analysts anticipate the corporate’s next-gen Blackwell Extremely GPUs to additional speed up progress, with Wall Road anticipating that Nvidia may quickly attain, and doubtlessly surpass, the $4 trillion market cap milestone.

Nvidia’s rise has additionally reshaped the broader inventory market. The corporate now represents a good portion of the S&P 500 index, and its efficiency has left many traders, together with these saving for retirement via index funds, more and more uncovered to the fortunes of the AI sector.

Microsoft, at the moment valued at $3.7 trillion, and Apple, at $3.19 trillion, spherical out the highest three Most worthy corporations. However Nvidia’s momentum has set a brand new benchmark for what is feasible within the expertise business.

Regardless of its dominance, Nvidia faces challenges, together with ongoing commerce restrictions that restrict the sale of its most superior chips to China, in addition to rising competitors from rivals creating customized AI {hardware}. Nevertheless, the corporate’s innovation pipeline stays sturdy, with growth into new markets reminiscent of autonomous automobiles and bodily AI programs, signaling that its affect within the tech world is more likely to persist.