WASHINGTON — The Republican-led Senate is predicted to maneuver ahead with a vote Thursday on a bipartisan crypto regulation invoice, however it’s unclear if sufficient Democrats will help it as negotiations between the 2 events are ongoing.

The Senate Banking Committee handed the GENIUS Act, which might create the primary U.S. regulatory framework for issuers of stablecoins, digital tokens pegged to currencies just like the greenback, in April, with 5 Democrats backing the laws.

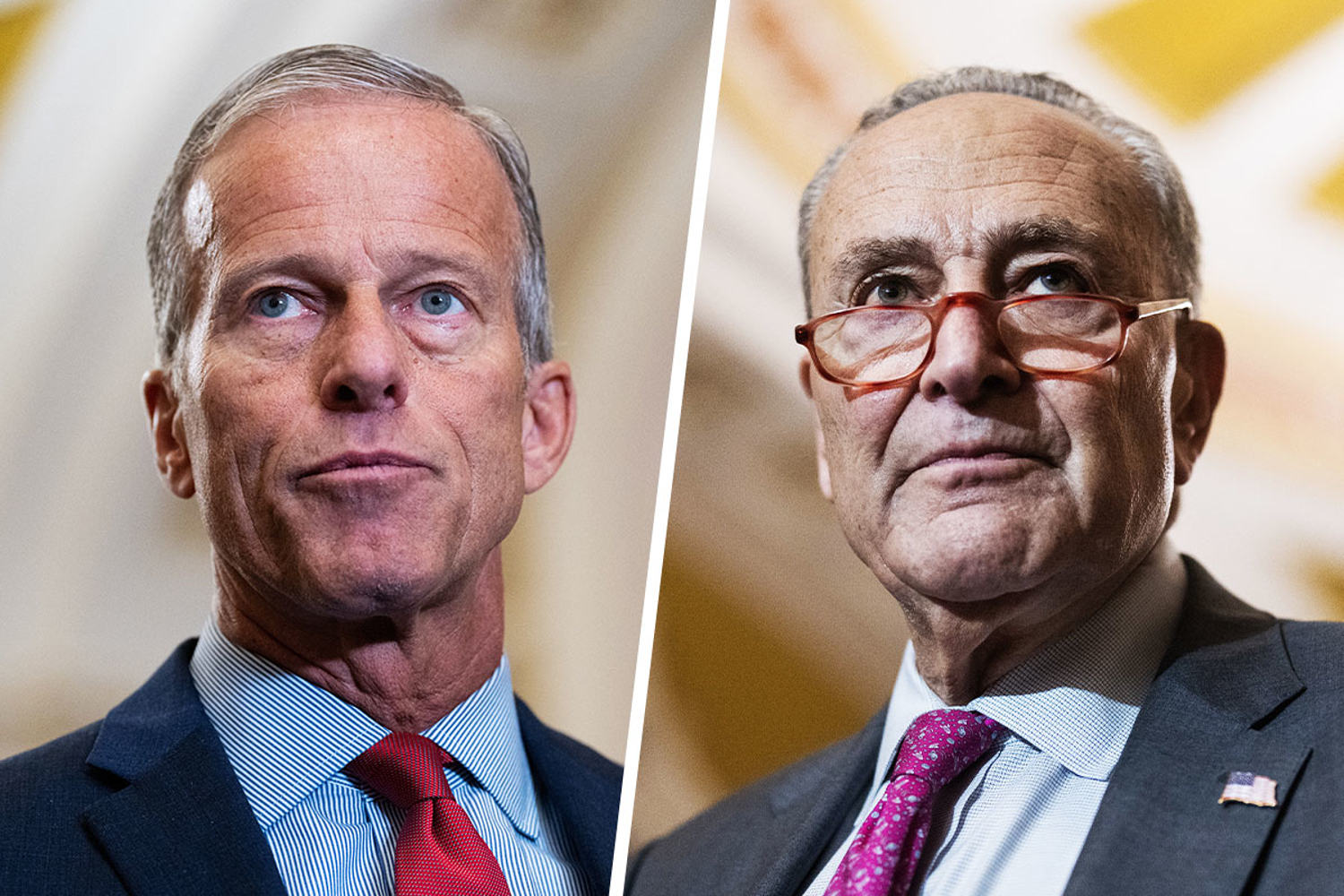

However after Senate Majority Chief John Thune, R-S.D., mentioned the Senate would swiftly take the measure up, Senate Minority Chief Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., the rating member on the Banking Committee, privately urged Democrats — together with those that help the invoice — to withhold their vote to extract extra concessions from Republicans, in response to three individuals with direct information of their feedback.

Thune mentioned on Thursday he’s nonetheless having conversations along with his Democratic colleagues about adjustments to the invoice, and expects to know throughout the subsequent few hours whether or not they have the votes to proceed.

“We’re attempting to see if there’s a path ahead that may allow us to get any adjustments that they want, further adjustments, as a result of we’ve had, like I mentioned, loads of them already made to the invoice, however in some unspecified time in the future they’re going to need to take sure for a solution.” Thune advised reporters Thursday.

Democrats are looking for specific provisions barring members of the manager department, together with President Donald Trump and his household, from proudly owning or buying and selling cryptocurrency and stronger anti-corruption provisions. The invoice requires 60 votes to advance to last passage within the Senate, the place Republicans maintain a 53-47 majority.

For greater than three hours on Wednesday morning, a bipartisan group of crypto-focused senators huddled within the workplace of Banking Committee Chair Tim Scott, R-S.C.

The listing included Sens. Invoice Hagerty, R-Tenn.; Cynthia Lummis, R-Wyo.; Mark Warner, D-Va.; Ruben Gallego, D-Ariz.; Kirsten Gillibrand, D-N.Y.; and Angela Alsobrooks, D-Md, in response to three sources accustomed to the assembly. The group held one other closed-door assembly on Wednesday night time for a number of hours and have but to succeed in a consensus.

Hagerty led negotiations with the Democrats who voted for the laws in committee however later backtracked on their help, citing in a press release “quite a few points that have to be addressed, together with including stronger provisions on anti-money laundering, international issuers, nationwide safety, preserving the protection and soundness of our monetary system, and accountability for individuals who don’t meet the act’s necessities.”

Republicans, in the meantime, heard from tech entrepreneur David Sacks for greater than an hour Wednesday, in response to a number of senators who attended the briefing.

“Nicely, we had a very good dialog yesterday,” mentioned Sen. Rick Scott, R-Fla., who helps the laws. “Everyone wants to know, buying and selling bitcoin is completely completely different than stablecoin.” (Bitcoin just isn’t pegged to fiat forex, just like the U.S. greenback.)

Requested if most members of Congress perceive what completely different digital belongings are and the way they’re used, Sen. Jon Husted, R-Ohio, chuckled.

“That’s an incredible query. I can’t converse for different individuals. I do know I’ve had to spend so much of time on it myself to actually perceive the problem,” he mentioned. “There is no such thing as a regulatory regime round this proper now. It’s the Wild Wild West, and we wish to begin to acknowledge that we’d like some safety round this.”

The shift in Democratic help comes after an Abu-Dhabi backed funding agency introduced final month that it’ll make investments billions of {dollars} within the Trump household crypto enterprise, World Liberty Monetary. The information of the funding sparked backlash from Senate Democrats, who argued that it’s “proof” that the president is utilizing his workplace to complement himself. And it comes after Trump held a $1.5 million-per-plate fundraiser on Monday targeted on high-profile crypto traders and tech entrepreneurs.

“The alternatives for grift — through which the Trump Administration presents favors to the UAE or to Binance in change for his or her large payouts — are mind-boggling,” Sens. Warren and Jeff Merkley, D-Ore., wrote in a Monday letter to Jamieson Greer, the appearing director of the Workplace of Authorities Ethics. (Binance is a cryptocurrentcy change.)

Warren and Gillibrand signed on to laws from Merkley that may ban presidents, lawmakers and their households from financially benefiting, issuing, endorsing or sponsoring crypto belongings, together with stablecoins. The Finish Crypto Corruption Act immediately targets Trump and his household’s crypto ventures, together with nontraditional cryptocurrency endeavors like Trump’s dinner and personal White Home tour for the highest traders in his meme coin, $TRUMP.

Sen. Chris Murphy, D-Conn., has joined the refrain of Democrats calling for laws that particularly targets meme cash like $TRUMP, introducing his personal broader proposal, together with Rep. Sam Liccardo, D-Calif., to crack down federal officers from utilizing their place to revenue off digital belongings.

The counter-messaging effort from Senate Democrats would seemingly fail within the GOP-controlled Senate. However Sen. John Kennedy, R-La., mentioned he can be in favor of barring “all public officers” from utilizing their positions to revenue off of cryptocurrency.

The GENIUS Act solely regulates stablecoins and doesn’t contact meme cash, a special sort of cryptocurrency that derives its worth from web tradition reasonably than from an underlying utility or asset. However proponents of the laws argue that the invoice does have protections in opposition to cash laundering and fraud.

Modifications have been made to the laws on the request of Democrats after it was reported out of committee, together with preserving state regulatory authority for foreign-issued stablecoins and broadening suspicious transaction monitoring and reporting for stablecoin customers, in response to two individuals accustomed to the method.

The draft invoice is predicted to include a provision that may ban elected officers from issuing stablecoins, in response to Thune and one Democratic aide concerned within the course of.

“I do know we may come to a very good, strong invoice. We simply must take the time to really work collectively on this,” Gallego advised reporters. “There’s loads of backsliding that occurred between the committee vote and the textual content that got here out. And I feel that we will get there, however the model that at present is in place just isn’t what we negotiated earlier than.”

Thune maintained he’s following “common order” and that additional adjustments to the invoice may occur throughout an modification course of, a step that’s solely unlocked if senators present 60 votes to advance the invoice first. The Home Monetary Companies Committee voted to cross a competing invoice, the STABLE Act, which might additionally present a regulatory framework for stablecoins, final month.

If the Senate in the end passes the invoice, the Home would nonetheless must take it up earlier than it may head to Trump’s desk for a signature.

“When will the Democrats take sure for a solution? And in the event that they produce other strategies and issues that they need included into the draft, we’re definitely welcome to looking at and dealing with them on that, however we have to begin transferring ahead,” Thune mentioned on Tuesday.

It’s not simply Senate Democrats reversing course: A couple of Republicans have indicated they plan to vote in opposition to the GENIUS Act, together with Sen. Josh Hawley, R-Mo., who mentioned that with out prohibiting tech corporations from proudly owning stablecoins, he’s not comfy supporting the invoice.

Sen. Rand Paul, R-Ky., who usually deviates from his celebration, mentioned he deliberate to vote in opposition to the laws resulting from fears of over regulation.

“I’m not an actual massive fan of federal rules interval, a lot much less beginning a complete new scheme for a complete new trade that exists and appears to be doing OK with out federal rules.” Paul advised reporters Tuesday.