Welcome to The Market’s Compass Rising Market’s Nation ETF Examine, Week #543. As at all times, it highlights the technical modifications of the 20 EM Nation ETFs that I observe on a weekly foundation and publish each third week. Paid subscribers will obtain this week’s unabridged Rising Market’s Nation ETF Examine despatched to their registered e-mail. In a belated celebration of Mom’s Day, free subscribers will even obtain the total model. Please think about turning into a paid subscriber. Previous publications could be accessed by paid subscribers through The Market’s Compass Substack Weblog. Subsequent week I can be publishing The Market’s Compass Developed Markets Nation ETF Examine. On Sunday I printed the newest version of The Market’s Compass Crypto Candy Sixteen Examine which I publish on a weekly foundation and tracks the technical modifications of sixteen of the bigger capitalized Cryptocurrencies.

To know the methodology utilized in developing the target EM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.

To know the methodology utilized in developing the target EM Nation ETF Particular person Technical Rankings go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.

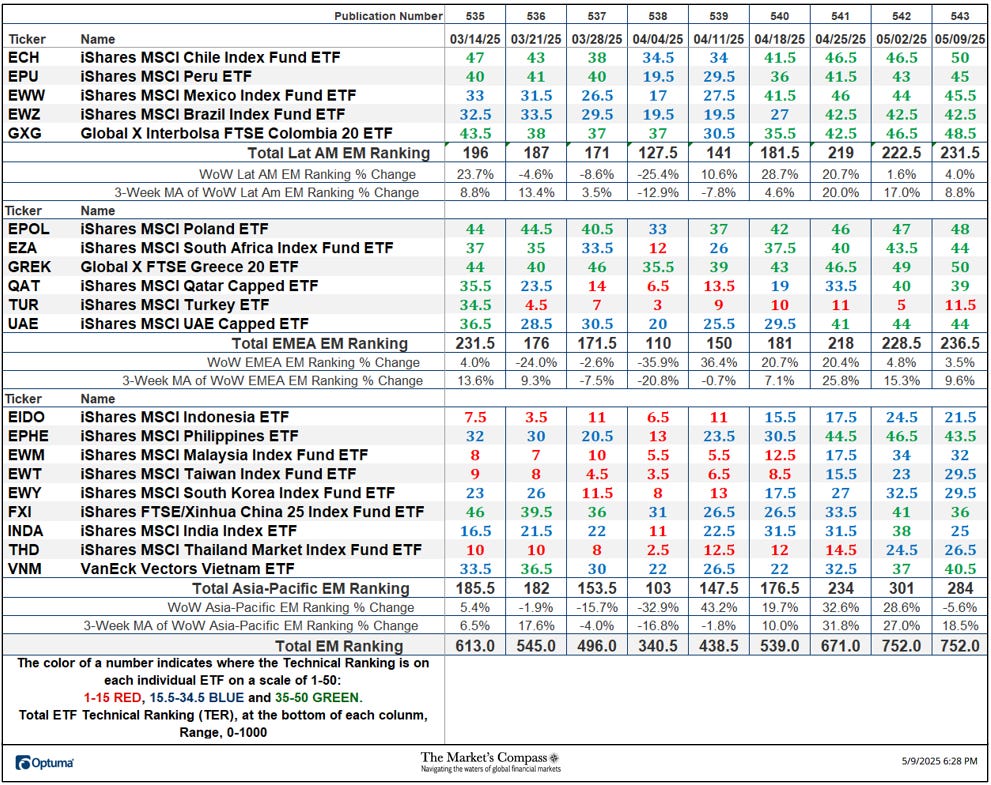

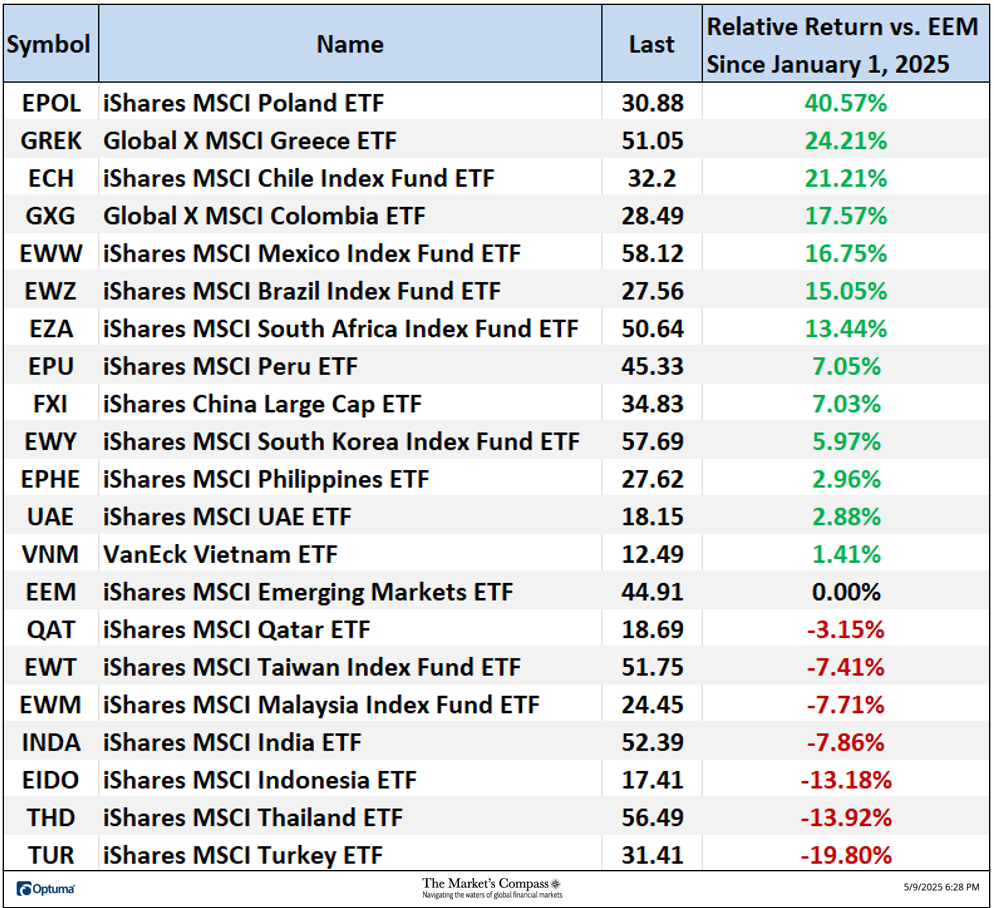

This previous week The Whole EM Technical Rating or “TEMTR” was unchanged from the earlier week, which was an increase of +12.07% from 671 three weeks in the past. The Whole Lat AM EM Rating led the opposite two geographic areas larger, rising 4% to 231.5 from 222.5. The EMEA EM Whole Technical Rating rose 3.5% to 236.5 from 228.5 the earlier week. The Whole Asia-Pacific EM Rating fell -5.6% to 284 from 301. That was small drop that adopted a +28.6% acquire the week earlier than.

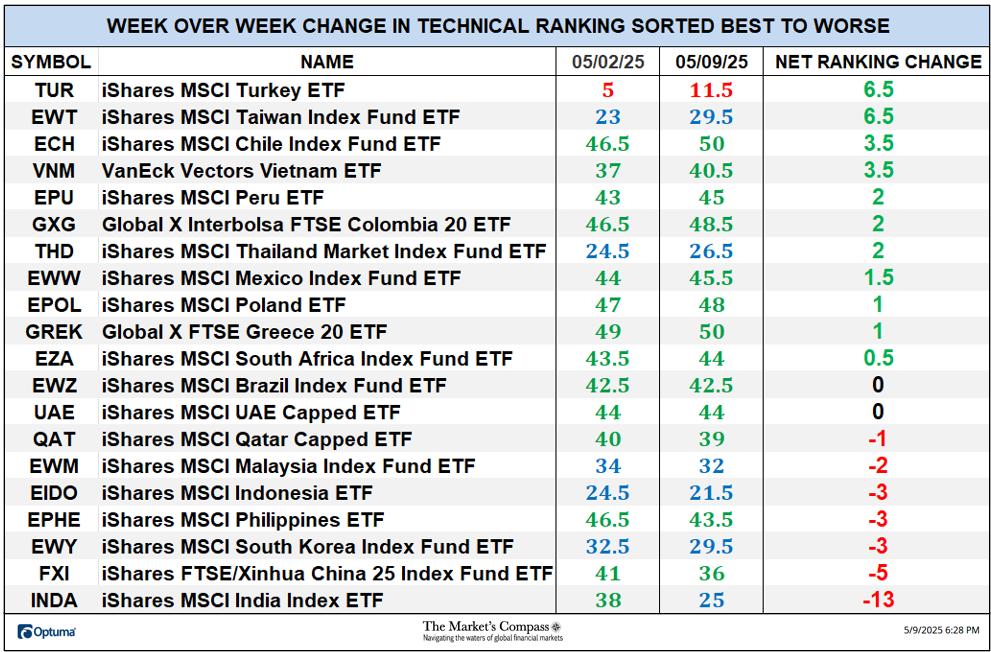

Eleven of the twenty EM Nation ETFs I observe in these pages registered enchancment of their TRs over the previous week, two had been unchanged, and 7 ETF TRs fell. The typical TR acquire was zero vs. the earlier week’s common TR acquire of +4.05. 13 of the EM Nation ETF TRs ended the week within the “inexperienced zone” (TRs between 34.5 and 50), six had been within the “blue zone” (TRs between 15.5 and 34) and one was within the “crimson zone” (TRs between 0 and 15) which was once more the iShares MSCI Turkey ETF. That was mainly unchanged from the earlier week when fourteen had been within the “inexperienced zone”, 5 had been within the “blue zone” and one within the “crimson zone”.

*To know the development the of The Technical Situation Components go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”.

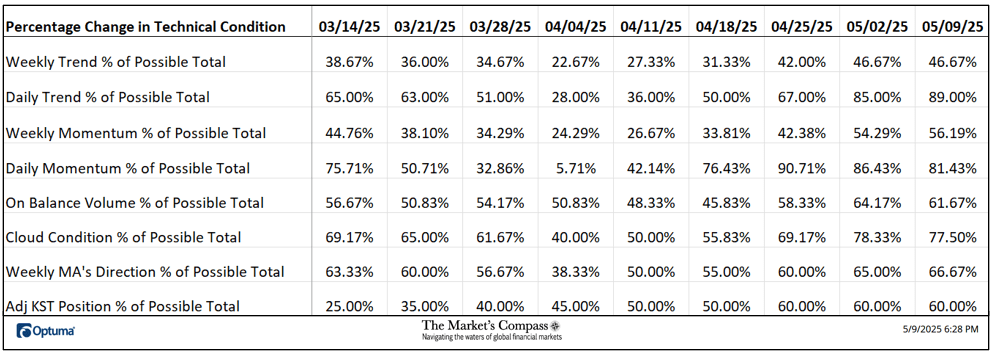

This previous week a 81.43% studying was registered within the Each day Momentum Technical Situation Issue (”DMTCF”) or 114 out of a potential whole of 140 constructive factors. That was barely decrease than the week earlier than overbought studying of 86.43% or 121.

As a affirmation device, if all eight TCFs enhance on a week-over-week foundation, extra of the 20 ETFs are bettering internally on a technical foundation, confirming a broader market transfer larger (consider an advance/decline calculation). Conversely if all eight TCFs fall on a week-over-week foundation it confirms a broader market transfer decrease. Final week three TCFs rose, two had been unchanged, and three fell.

*A quick clarification of easy methods to interpret RRG charts go to the mc’s technical indicators web page at www.themarketscompass.com and choose “em nation etfs”. To be taught extra detailed interpretations, see the postscripts and hyperlinks on the finish of this Weblog.

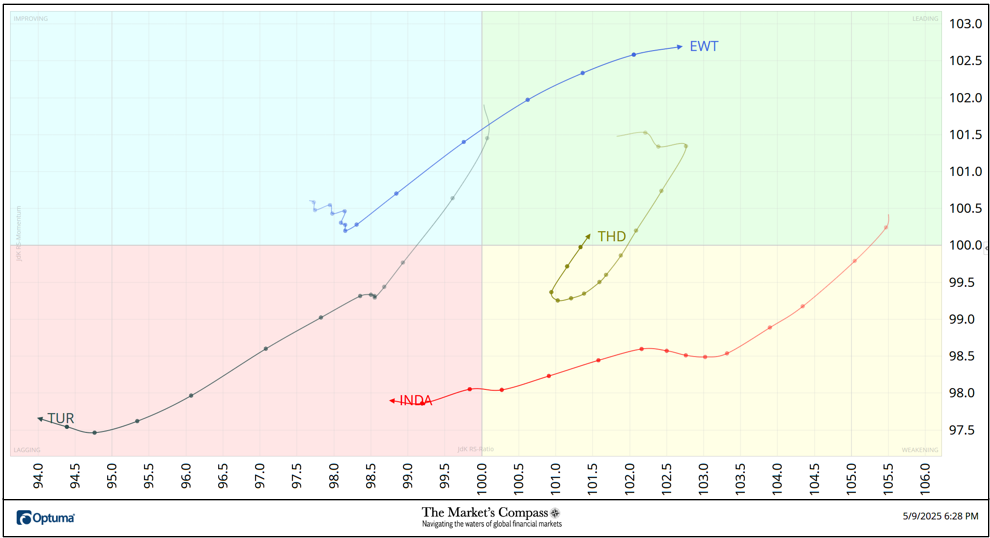

The chart beneath has three weeks, or 15 days, of Relative knowledge factors vs. the benchmark, the EEM (the Rising Markets ETF), on the middle, deliniated by the dots or nodes. Not all 20 ETFs are plotted on this RRG Chart. I’ve finished this for readability functions. These which I imagine are of upper technical curiosity stay.

After “waffling” within the Enhancing Quadrant three weeks in the past the iShares MSCI Taiwan Index Fund ETF (EWT)” lifted off “, displaying sturdy upside Relative Energy Momentum and early final week it moved sharply into the Main Quadrant exhibiting constructive Relative Energy. The iShares MSCI Thailand Market Index Fund ETF (THD) had fallen into the Weakening Quadrant however late final week it did an about face and hoked larger and ended the week again into the Main Quadrant. The iShares MSCI India Index ETF (INDA) has made a 3 quadrant transfer over the previous three weeks by falling from the Main Quadrant into the Weakening Quadrant and monitoring into the Lagging Quadrant wiping out all of its Relative Energy. The iShares MSCI Turkey ETF (TUR) continues to trace decrease within the Lagging Quadrant after a short pause two weeks in the past.

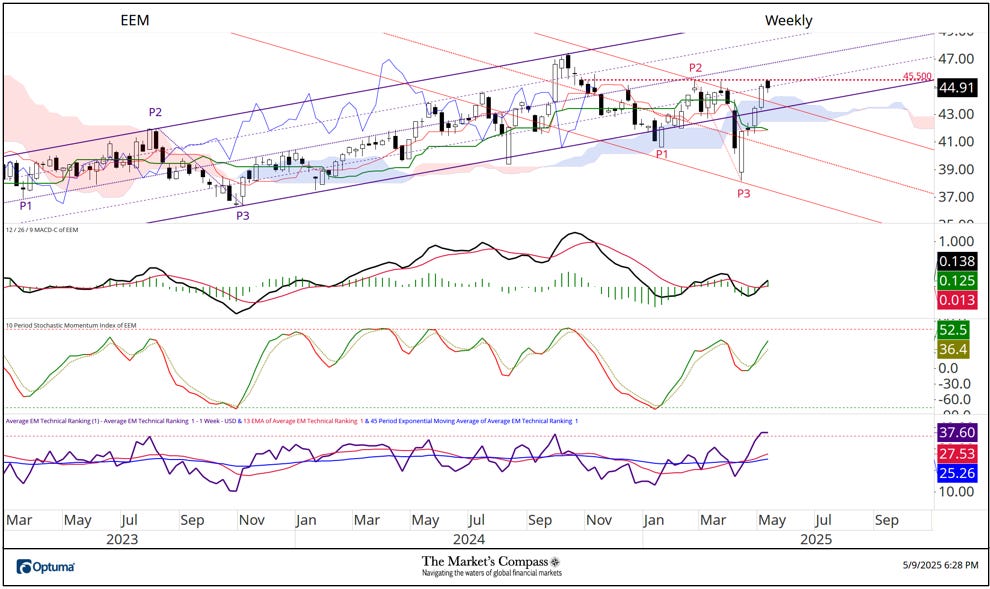

The iShares MSCI Rising Markets Index ETF traded down barely ending final week down -0.20% at 44.91, which was solely a shallow pullback from the week earlier than +3.57% acquire. The Whole ETF Rating was flat at 752 WoW however had risen sharply up +12.02% from 671 and up from 539 the week earlier than. The “TER” has come to relaxation at a close to overbought degree that has led to cost pullbacks since early 3023. Extra on the technical situation of the EEM on the shorter-term Weekly Candlestick / Cloud Chart that follows…

The EEM has put collectively a well being rally over the previous 5 weeks from the worth reversal low at P3 that has retaken the bottom above Kijun Plot (inexperienced line), the Decrease Parallel of the longer-term Customary Pitchfork (violet P1 by means of P3), Cloud resistance, and the Higher Parallel (stable crimson line) of the newly drawn shorter-term time period Customary Pitchfork (crimson P1 by means of P3) leaving little query that the downturn from final October’s highs have run its course. The one roadblock to the advance was worth resistance that capped final week’s rally at 45.50. My solely concern is that the Common EM Technical Rating has reached a degree that has led to cost pullbacks. That mentioned, each worth momentum oscillators aren’t hinting at a lack of upside worth momentum.

Find out about Pitchforks and Inside Strains within the three-part Pitchfork tutorial within the Market’s Compass web site, www.themarketscompass.com

Extra on the technical situation of the EEM in Ideas on the Brief-Time period Technical Situation of the EEM however first…

Doesn’t embrace dividends if any.

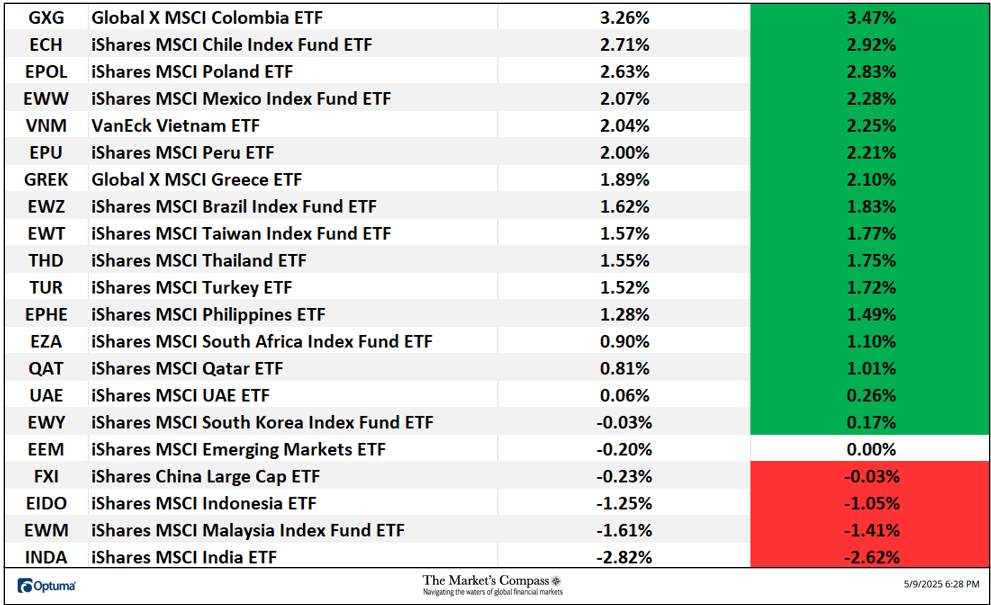

Fourteen of the twenty EM Nation ETFs had been up on an absolute foundation final week and 6 traded decrease (together with the small worth decline within the EEM). Sixteen EM ETFs outperformed the -0.20% loss within the EEM on a relative foundation. The typical four-day absolute acquire within the EM ETFs was +0.99%, including to the earlier week’s common absolute acquire of +2.26% serving to once more to reverse the -6.80% common absolute loss registered 4 weeks in the past.

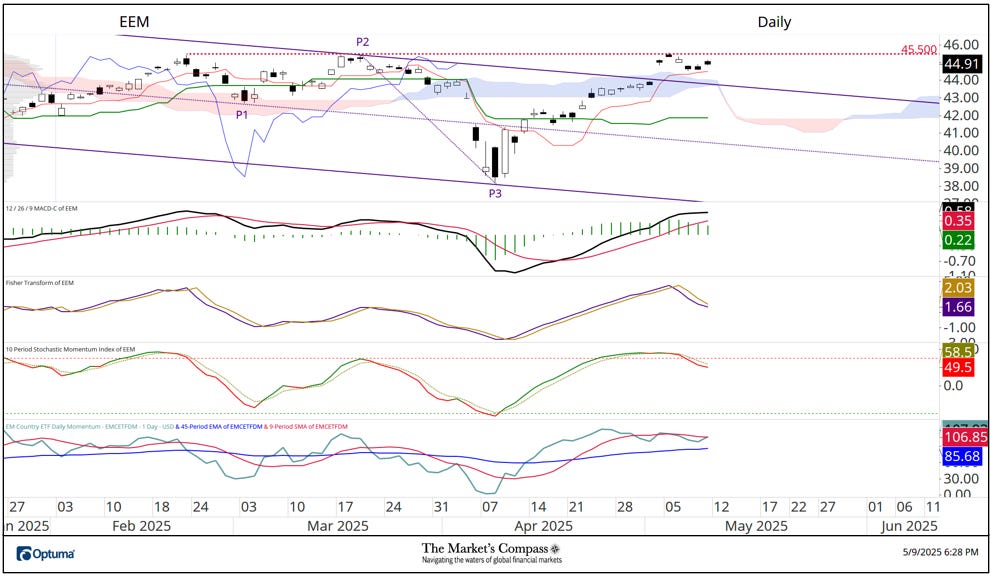

As we noticed earlier on the Weekly Chart, the rally within the EEM stalled final week at slightly below worth resistance on the 45.50 degree after costs overtook the Each day Customary Pitchfork’s (violet P1 by means of P3) Higher Parallel (stable violet line) and Cloud resistance. Within the brief time period the static worth motion led to the slowing of upside momentum final week as witnessed by the Stochastic Momentum Index rolling over by means of its sign line. That mentioned MACD stays above its sign line in constructive territory. My EM Nation Each day Momentum / Breadth Oscillator has been monitoring sideways for the reason that finish of April. Final week’s worth motion means that it’s merely a pause to refresh however help on the Higher Parallel of the Pitchfork on the 43.75 degree should maintain for that technical thesis to be appropriate.

The iShares MSCI Rising Markets ETF, EEM, is up 7.39% YTD.

All of the charts are courtesy of Optuma whose charting software program permits anybody to visualise any knowledge together with my Goal Technical Rankings. The next hyperlinks are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

To obtain a 30-day trial of Optuma charting software program go to…

www.optuma.com/TMC.