By

In simply 5 years, lithium-ion battery fires linked to e-mobility gadgets have developed from a fringe threat right into a mainstream security and legal responsibility disaster – notably in dense city areas, like New York Metropolis, the place adoption of those gadgets has outpaced regulatory safeguards.

Along with the plain public security menace, e-mobility battery associated fires characterize a major and increasing legal responsibility publicity for insurers, property managers, and metropolis businesses. Our newest report – developed in collaboration with Oxford Economics – units out to reply a extra basic query: What is that this disaster actually costing the town?

The reply, conservatively estimated, is as much as $519 million in mixed human and financial loss between 2019 and 2023. This determine contains fatalities, accidents, and structural property harm

Why Now? Why New York?

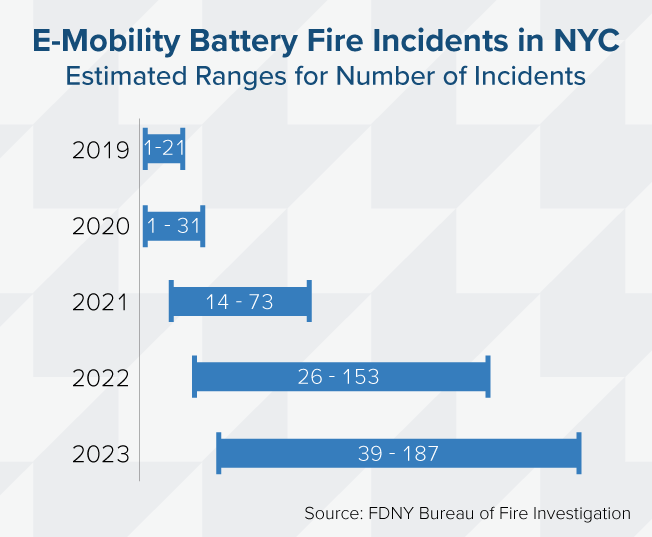

The dramatic rise in fireplace incidents – an estimated eightfold enhance from 21 in 2019 to as many as 187 incidents in 2023 – correlates strongly with the inflow of low-cost, uncertified e-bikes and scooters. New York Metropolis’s distinctive mixture of site visitors congestion, delivery-based gig work, and dense multi-family housing has made it a case examine in how rapidly innovation can outstrip threat administration.

Knowledge from the Fireplace Division of New York, the Client Product Security Fee, and UL Options’ Lithium-Ion Battery Fireplace Incident Database shaped the inspiration of our modeling. This helped us generate incident estimates of fatalities, accidents, and structural properties damages.

Oxford Economics translated these incident reviews into value estimates utilizing a rigorous, conservative methodology by making use of federal valuation metrics for lack of life and harm. Fatality prices had been calculated utilizing the U.S. Division of Transportation’s Worth of a Statistical Life, set at $13.2 million per life as of 2023. Non-fatal harm prices had been derived as severity-weighted fractions of that worth, starting from minor harm to important harm, in accordance with DOT and Workplace of Administration and Price range financial steerage.

Our evaluation then built-in structural fireplace value benchmarks from each Triple-I and the Nationwide Fireplace Safety Affiliation. Triple-I’s information was notably necessary in defining the upper-bound estimates for property loss. Claims information on the typical insurance coverage payout for residential fireplace harm supplied a grounded, actuarial counterweight to NFPA’s generalized nationwide averages.

This dual-source strategy allowed us to seize a extra reasonable vary of seemingly losses throughout completely different housing varieties, from NYCHA public models to personal properties.

A rising blind spot for insurers

From a risk-modeling standpoint, e-mobility fireplace incidents don’t map simply to standard insurance coverage classes. Many e-mobility customers, notably gig financial system employees, depend on leased, used, or modified e-bikes and e-scooters to satisfy supply calls for. A few of these gadgets are powered by third-party or uncertified batteries or, in some situations, include second-hand elements. This creates a messy threat atmosphere wherein it’s laborious to know who owns what, the way it has been maintained, or the way it’s getting used. Furthermore, fires ensuing from these gadgets usually fall exterior the scope of ordinary product warranties or producer duty. This makes it troublesome to find out who’s accountable when one thing goes incorrect.

For insurers, this presents a rising blind spot. Conventional assumptions round property and contents protection didn’t embrace high-risk gadgets charged in hallways or shared dwelling areas or for ignition sources that aren’t a part of typical product recall channels.

A $300 imported battery with no certification can set off a six-figure declare, and people dangers have gotten extra frequent.

The Path Ahead

Regulatory momentum is enhancing. New York Metropolis’s Native Regulation 39, signed in 2023, bans the sale and lease of uncertified e-mobility gadgets. In July 2024, New York Governor Hochul enacted further statewide measures to help battery security and consumer training. Federal laws geared toward establishing nationwide security necessities for lithium-ion batteries utilized in e-bikes and e-scooters is making its method by means of Congress. Whereas these are constructive steps, enforcement and consciousness stay uneven, leaving important gaps in client safety and threat mitigation.

From our perspective at ULSE, a multi-pronged technique is crucial:

- Higher enforcement of security requirements for batteries and chargers.

- Extra strong public training on protected charging practices.

- Commerce-in and swap packages that encourage supply employees to discard unsafe batteries.

- Underwriting fashions that take into account machine certification, client conduct, and constructing kind.

- Improved incident reporting frameworks that allow cities and insurers to gather higher information and subsequently higher observe threat publicity.

With higher information, smarter requirements, and extra coordinated public-private motion, the way forward for e-mobility will thrive with security at its heart.

Mr. Deb will probably be among the many threat and insurance coverage business thought leaders talking at Triple-I’s Joint Business Discussion board (JIF) in Chicago on June 18, 2025. It’s not too late to register to attend this insight-driven occasion.