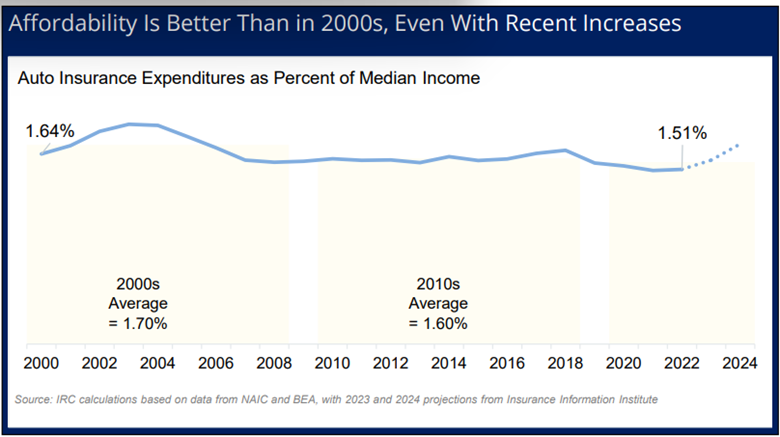

You learn that proper. As a share of median family revenue, private auto insurance coverage premiums nationally have been extra inexpensive in 2022 (the latest information accessible) than they’ve been for the reason that starting of this century.

And even the premium will increase of the previous two years are solely anticipated to convey affordability again into the 2000 vary, in keeping with the Insurance coverage Analysis Council (IRC).

A brand new IRC report – Auto Insurance coverage Affordability: Countrywide Traits and State Comparisons – seems on the common auto insurance coverage expenditure as a p.c of median revenue. The measure ranges from a low of 0.93 p.c in North Dakota (essentially the most inexpensive state for auto insurance coverage) to a excessive of two.67 p.c in Louisiana (the least inexpensive).

The ache is actual

This isn’t to downplay the ache being skilled by customers – notably these in areas the place premium charges have been rising whereas family revenue has been flat to decrease. It’s simply to supply perspective as to the varied components that come into play when discussing insurance coverage affordability.

Between 2000 and 2022, median family revenue grew considerably quicker than auto insurance coverage expenditures, inflicting the affordability index to say no from 1.64 p.c in 2000 to 1.51 p.c in 2022. In different phrases, auto insurance coverage was considerably extra inexpensive in 2022 than in 2000.

“With the current will increase in insurance coverage prices, affordability is projected to deteriorate in 2023 and 2024,” mentioned Dale Porfilio, FCAS, MAAA, president of the IRC and chief insurance coverage officer at Triple-I. “The affordability index is projected to extend to roughly 1.6 p.c in 2023 and 1.7 p.c in 2024, a big enhance from the low in 2021 however nonetheless beneath the height of 1.9 p.c in 2003.”

In different phrases, we’ve been right here earlier than; and, if dangers and prices may be contained, so can premium progress in the long run.

Value components fluctuate by state

Auto insurance coverage affordability is basically decided by the important thing underlying price drivers in every state. They embrace:

- Accident frequency

- Restore prices

- Declare severity

- Tendency to file damage claims

- Harm declare severity

- Expense index

- Uninsured and underinsured motorists

- Declare litigation.

These components fluctuate broadly by state, and the IRC report seems on the profiles of every state to reach at its affordability index.

Lowering threat and prices is vital

Porfilio famous that “whereas state-level information can not immediately tackle affordability points amongst historically underserved populations, collaborative efforts to scale back these key price drivers can enhance affordability for all customers.”

Continued replacement-cost inflation is prone to preserve upward strain on premium charges. Tariffs might exacerbate that development, in addition to hurting family revenue in areas depending on industries prone to be affected by them.

On the identical time, some states are working onerous to ameliorate different components hurting affordability. Florida, for instance, was the second least inexpensive state for auto insurance coverage in 2022; nonetheless, the state has made current progress to scale back authorized system abuse, a significant contributor to claims prices within the Sunshine State. In 2022 and 2023, Florida handed a number of key reforms which have led to vital decreases in lawsuits. Consequently, insurers have been writing extra enterprise within the state after a multi-year exodus. This elevated competitors places downward strain on charges, which needs to be mirrored within the IRC’s subsequent affordability research.

Be taught Extra:

IRC Report: Private Auto Insurance coverage State Regulation Methods

IRC Report: U.S. Customers See Hyperlink Between Legal professional Involvement in Claims and Greater Auto Insurance coverage Prices

Florida Reforms Bear Fruit as Premium Charges Stabilize

What Florida’s Misguided Investigation Means for Georgia Tort Reform

Florida Payments Would Reverse Progress on Expensive Authorized System Abuse

Inflation Continues to Drive Up Customers’ Insurance coverage Prices

Improved Industrial Auto Underwriting Profitability Anticipated After Years of Wrestle

Louisiana Is Least Reasonably priced State for Private Auto Protection Throughout the South and U.S.

Georgia Is Among the many Least Reasonably priced States for Auto Insurance coverage

Report: No-Fault Reforms Improved Michigan’s Private Auto Insurance coverage Affordability

Auto Insurers’ Efficiency Improves, However Don’t Count on Charges to Flatten Quickly