What’s going to seemingly occur to actual property through the subsequent recession? I can not see the long run, and I’m positive to be unsuitable. However I’ll take a look at what occurred prior to now to make an informed guess.

The Three Sorts of Recessions

At the price of oversimplification, we will group recessions into three completely different classes:

- Tightening financial coverage (Nineteen Seventies, Eighties, and presumably the close to future).

- A bubble that pops (the dot-com and housing bubbles within the 2000s).

- A shock (akin to a battle or a pandemic).

Recession No. 1: Tightening financial coverage

When a recession is attributable to tightening financial coverage, akin to mountain climbing rates of interest to chill inflation (which slows the economic system and may trigger a recession), it appears homebuying demand cools or drops, which often impacts actual property first.

After which as soon as the Federal Reserve drops charges, homebuying demand often will increase, so actual property is often the primary to get well. In these recessions, actual property might be referred to as a “first-in, first-out” asset.

One may argue that the financial surroundings we’re in right this moment is constrained by tightened financial coverage (although rates of interest are at historic averages, not historic highs).

Recession No. 2: A bubble pop

If a recession happens on account of a hypothesis bubble popping, that trade and the inventory market often undergo first earlier than actual property.

Examples:

- The railroad crash of 1873 concerned a railroad inventory bubble.

- The dot-com bubble of 2000 concerned a dot-com and tech inventory bubble.

- The Nice Recession of 2008 primarily concerned a single-family actual property bubble. Traders taking on leverage to take a position on these property solely made the issue worse.

If the following recession is because of one other bubble of overinflated residence costs, historical past tells us that residence costs will sharply right. It’s additionally value noting that actual property noticed a small dip in worth in 2001 however bounced again shortly.

Recession No. 3: A shock

If a recession happens on account of a shock akin to a battle or a pandemicjourney and commerce often undergo first. Actual property can change into a protected haven throughout these instances.

A Transient Be aware on Financial Deflation

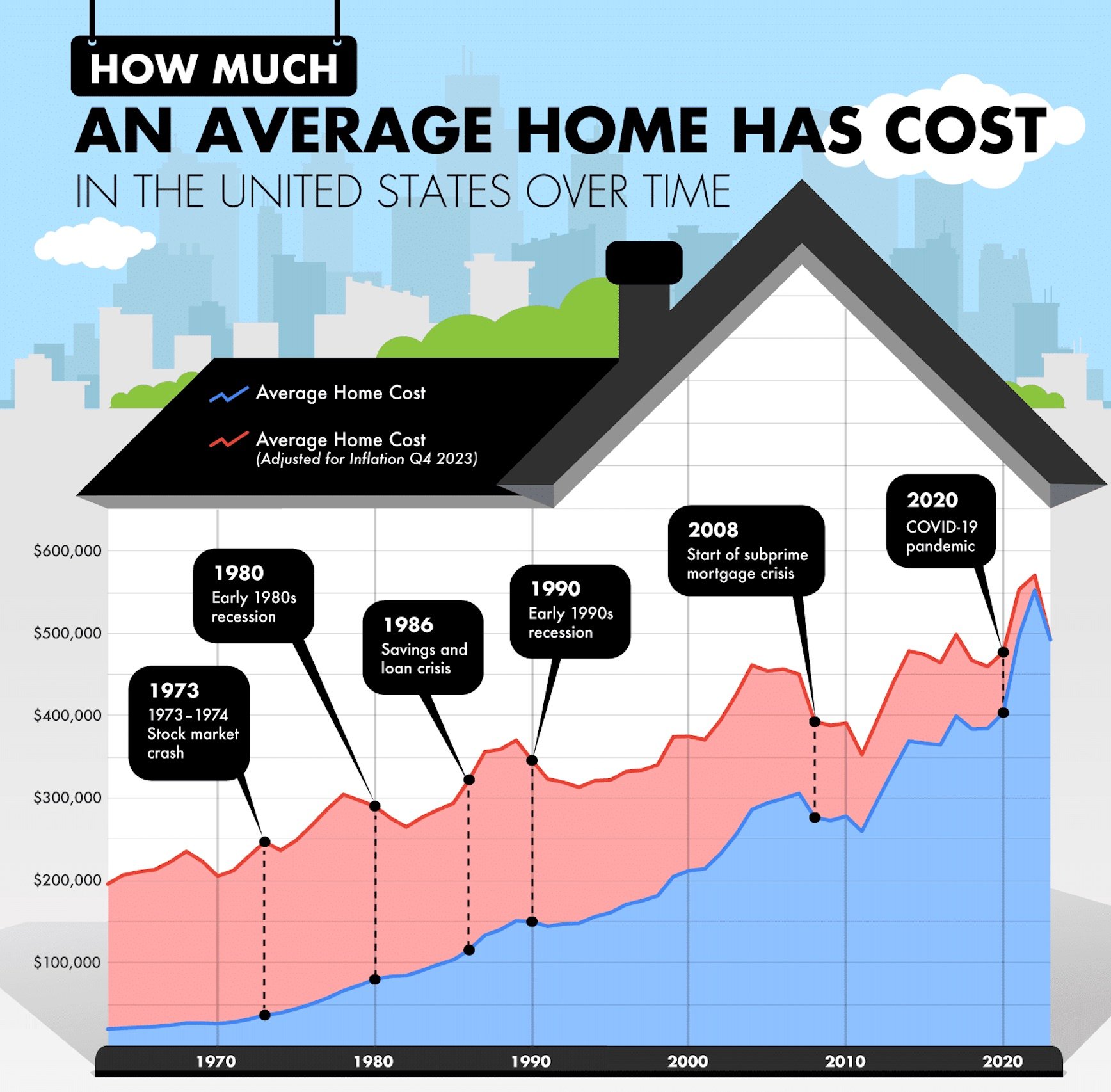

Historical past additionally tells us that residence coststogether with different property, can drop if we enter a deflationary interval.

That is the place costs of property drop, however their debt stays mounted, which might trigger a deflation “downward spiral” as enterprise revenues could lower. This then could trigger companies to deflate wages, which implies individuals are paid much less over time, which implies they’ve much less to spend, and so forth.

The final time we noticed main deflation within the U.S. was the Nice Despair virtually 100 years in the past. I’m not contemplating this within the realm of possible outcomes for the close to future.

Now, let’s particularly take a look at the previous six recessions to see how actual property fared.

The Earlier Six Recessions

1. 1973 (Stagflation)

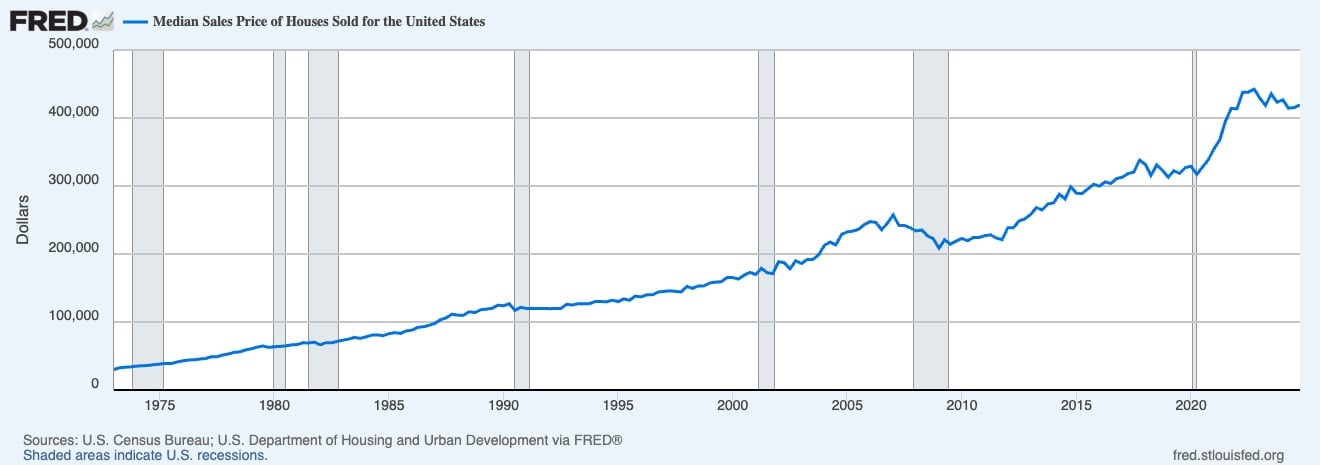

This period of stagflation was on account of forces like an oil embargo, inventory market losses, and inflation. Actual property was not the primary asset class to undergo, however undergo it did. The common 30-year mounted mortgage charge was about 9.70% within the first half of 1974.

2. 1980 (Inflation, financial tightening, “the “double-dip recession”)

Excessive charge hikes (mortgage charges hit above 17%) led to big declines in residence gross sales and a slight decline in costs (sound acquainted?). Actual property was one of many first asset lessons to get hit, but it surely was additionally not the primary asset class to get well for the reason that recession ended whereas rates of interest have been nonetheless excessive. And if we account for inflation-adjusted costs, the median residence worth didn’t get well till 1986.

3. 1990 (Financial savings & mortgage disaster, Gulf Struggle oil shock)

Financial savings and mortgage (S&L) corporations have been deregulated within the Eighties, which led to dangerous lending practices on industrial loans and in the end to the failure of over 1,000 banks and a wave of foreclosures for industrial actual property properties. In 1992, the inventory market recovered first earlier than actual property did.

It’s additionally value noting there was a decline in inflation-adjusted residence costs, which didn’t get well till the 12 months 2000.

4. 2001 (Dot-com bubble, 9/11 shock)

Whereas the inventory market skilled a decline, residence costs didn’t. Traders shifted their money to the safer asset of actual property. As well as, the Fed additionally slashed rates of interest, which additional fueled homebuying. This is when actual property entered its speculative bubble period.

5. 2008 (Housing bubble and monetary disaster)

This recession was primarily attributable to hypothesis within the housing markettogether with the subprime mortgage disaster, resulting in the largest collapse of residence costs in trendy historical past. Nonetheless, it’s value declaring that residence costs dropped much more through the Nice Despair.

6. 2020 (COVID shock)

This was the shortest recession ever recorded (two months lengthy). However its impression remains to be being felt right this moment.

“Shock” recessions can lead to elevated demand for actual property, as it’s seen as a comparatively protected asset. Residential residence costs noticed their quickest development in trendy historical past, whereas workplace properties noticed a main correction. Following the extreme inflation that occurred after COVIDin 2022, rates of interest have been hikedwhich induced a “lock-in” impact for current householders, not desirous to promote and purchase a brand new property with greater charges. This has led to decrease housing stock on the market, retaining costs elevated.

Actual Property and the Subsequent Recession

Financial tightening, bubbles, or shocks seem like the first causes of recessions. So what in regards to the subsequent recession?

The tightening financial coverage we noticed from 2022-2024 has to this point restricted inflation and never induced a recession (by the formal definition); we’re in a profitable “tender touchdown” as of the time of this writing. Nonetheless, the Shopper Confidence Index dropped 7.2 factors from February to March and is the bottom it’s been since January 2021, when the nation was nonetheless coping with the pandemic. As well as, when Trump introduced his “reciprocal tariffs” plan on April 2, the inventory market plunged essentially the most since 2020.

I believe what could occur to actual property through the subsequent recession will rely upon what sort of recession it occurs to be.

We’ve seen traditionally that if it’s a “shock recession,” then actual property could also be seen as a safer asset, and costs could rise (except the shock impacts the land itself, akin to governmental instability, battle, or a pure catastrophe). We will already see traders fleeing to different protected monetary devices just like the 10-year Treasury for the reason that begin of 2025.

If it’s a “bubble-popping recession,” then except the bubble is straight associated to housing, residence costs could also be unaffected relative to the broader market. I don’t suppose the housing market is in any form of bubble. Nearly all of householders have low mortgage charges and excessive fairness. Lending practices are additionally a lot stricter than they have been pre-2008; to qualify for a house mortgage, you actually do want to have the ability to afford a mortgage first.

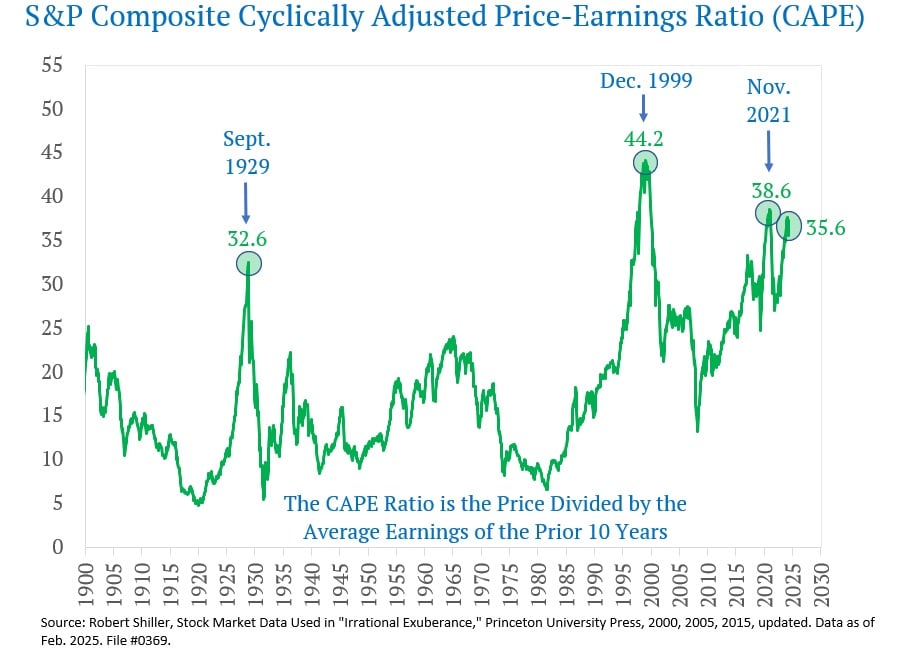

If there may be such a bubble that at the moment exists, it may be the inventory market, which at the moment has the third-highest cyclically adjusted price-to-earnings (CAPE) ratio prior to now 100 years.

This may recommend the inventory market is overvalued and due for a correction. However once more, that is information on the inventory market, not the housing market. For what it’s value, I believe that is the probably correction we’ll see within the close to future.

Fast Replace: This week, the S&P 500 dropped essentially the most since 2020 after Trump introduced “reciprocal tariffs.” Maybe that is the start of the correction. Solely time will inform.

If the recession is expounded to financial coverage, residence worth development could stall or briefly decline earlier than bouncing again after the recession ends. One may argue that we’re at the moment seeing this or about to enter into this type of interval, akin to the Nineteen Seventies and Eighties.

Maybe the subsequent recession will be a mixture of the overvalued inventory market correcting (low development) and tightened financial coverage (higher-than-2010s-interest charges) with greater inflation (new tariffs). We’d even see stagflation for the primary time for the reason that Nineteen Seventies.

Closing Ideas

We’ve seen the inflation-adjusted median residence worth drop by:

- 4% through the 1973 stagflation recession,

- 8% within the 1980 recession, and

- 6% within the 1990 recession.

Residence costs didn’t decline after the 2001 recession however as a substitute dropped massively in the 2008 recession. And I believe stagflation (a mixture of a inventory market correction, elevated rates of interest, and sticky inflation because of tariffs) is a extremely seemingly situation for the approaching years as of this writing.

I believe now will not be the time to be extremely leveragedand I’d argue in opposition to utilizing the three.5% FHA mortgage—a minimum of not except the property is self-sustaining. However I simply predicted the long run in a weblog put up, which implies I’ll seemingly be unsuitable.

And for what it’s value, all recessions finish ultimately, and the inflation-adjusted worth of actual property continues to steadily climb. Simply be sure you can journey out the following cycle.